Second, you need to pick any qualified costs associated with new HELOC. The fresh TCJA limitations the newest deduction getting attract to the domestic collateral finance and you will HELOCs so you can expenses associated with the acquisition, framework or upgrade regarding a professional domestic. In terms of home improvements and you can solutions, for example substitution the fresh new roof, establishing a different Heating and cooling program, refinishing wood floors, landscaping, masonry functions and much more.

All these facts is sold with multiple costs, also work and you may materials. It is vital to tune these types of costs very carefully and maintain reveal list of all expenses associated with your own HELOC-financed methods. It means documenting how much cash you spent on each passion including keeping any receipts and you can statements. Lender comments will also help render a detailed report path out of all of these deals if there is a keen Internal revenue service review.

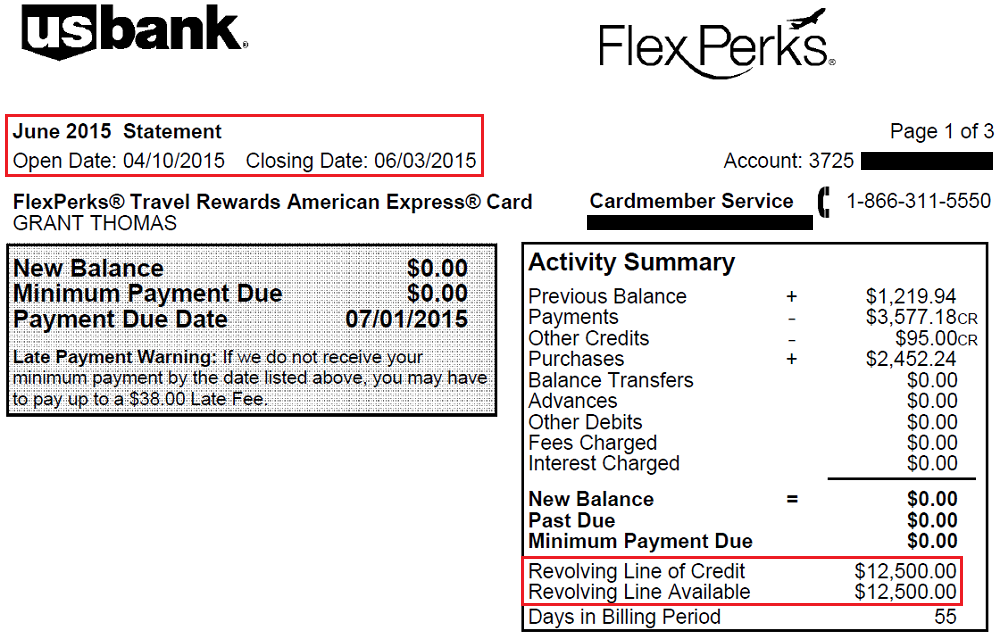

After you have achieved every needed documents of your licensed HELOC-financed expenses and factors, it is the right time to assess the amount of attract you’ve paid off in your mortgage. Your own month-to-month HELOC comments offers an in depth breakdown of the full appeal repaid more than confirmed months. Such as for example, for those who took aside an effective HELOC within the and repaid interest to your it throughout the season, the report will show the level of attract purchased the fresh new entire year. Your own lender should also deliver a questionnaire 1098 annually one to lines the degree of loan focus you purchased income tax objectives.

4. Establish the deductible desire

After you have determined their overall home loan attention repaid, it is vital to be sure the total deduction matter. Just remember that , HELOC focus is income tax-allowable towards the first $750,000 off full being qualified indebtedness ($375,000 in the event that married processing ounts beyond the earliest $750,000 is not income tax-allowable. You will need to add up the amount of HELOC notice taken care of the income tax season, deduct people non-deductible numbers and you may go into the full in your income tax return.

5. While in question, consult a tax elite group

Just as in other significant tax-relevant issues, it is best to consult with a qualified income tax professional if the you will be not knowing for you to securely report their HELOC tax make-away from. A specialist will assist make sure you will be precisely reporting the HELOC focus income tax deduction to the Irs, also provide good advice on the virtually any it is possible to income tax-rescuing actions that’ll connect with your unique situation.

Almost every other taxation effects of HELOCs

Aside from the HELOC taxation implications listed above, you can find tax-relevant things value clarifying. In the first place, HELOCs aren’t taxed as the regular her response income, as they show currency loaned rather than made. Next, particular jurisdictions (a number of claims and shorter municipalities) impose a home loan recording income tax towards family security loans and you can HELOCs, that’s generally speaking a share of your complete amount borrowed. Lastly, subtracting desire repayments to own HELOCs will require one to grab an enthusiastic itemized deduction rather than the simple deduction. Occasionally, you can are obligated to pay smaller in the taxes by simply using the practical deduction.

Does HELOC apply to property fees?

In most jurisdictions, precisely the appraised value of your house and also the relevant local tax rates influence your property goverment tax bill. Therefore, the level of HELOC you’re taking aside won’t apply to your house taxes. But not, if you use arises from the newest HELOC to invest in specific home improvements otherwise enhancements you to definitely make the appraised property value their home-going upwards, then your assets fees could potentially improve. Such, by using a beneficial HELOC to add another type of pond otherwise generate other high developments toward property, your neighborhood assessor might take that it under consideration when quoting brand new property value your property to possess taxation motives.