If you have handmade cards which might be charging you a dozen%+ in focus and you are clearly only able to make minimal percentage, it the right position where it’s a good idea when planning on taking a loan from the 401(k) and you will benefits the financing notes. However,………but…….that is simply a good clear idea if you are not going to run up those individuals credit card stability once more. When you are in a really crappy financial situation and you may be on course having case of bankruptcy, that it is better not when deciding to take currency from your 401(k) since your 401(k) account is actually shielded from creditors.

Connection A short-Title Cash Crisis

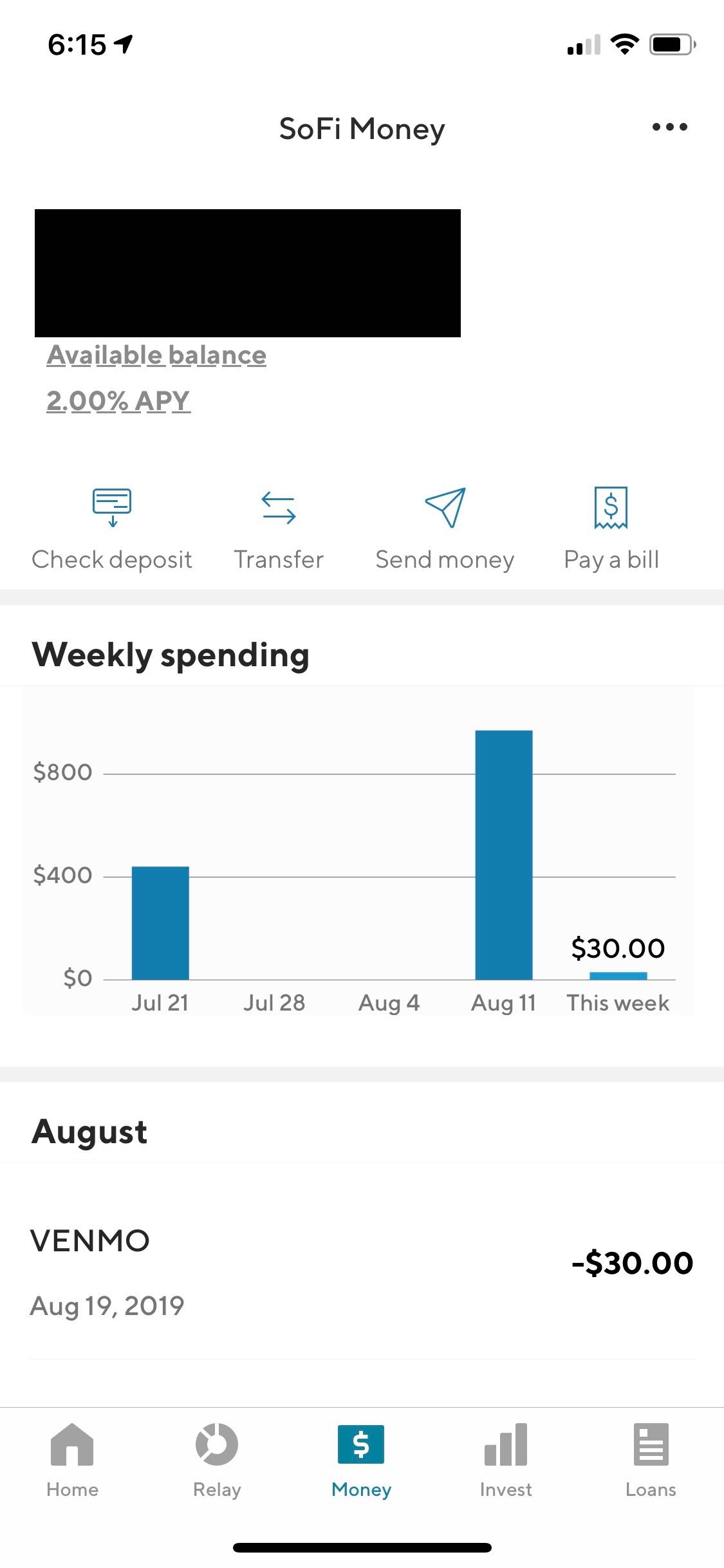

For folks who come upon a short-title bucks crisis where you enjoys a large costs although money must shelter the costs is put off, an effective 401(k) financing ple would be selling and buying property additionally. If you like $30,000 into down-payment on your own new home and you had been expecting to get that money from the brand new proceeds from the bad credit installment loans Hammond IN latest purchases of your own latest home nevertheless closing on your own latest household gets pushed right back of the thirty days, you could plan to grab a great $30,000 financing from your own 401(k), personal into the brand new home, and make use of the proceeds from the fresh new deals of latest household in order to payoff the brand new 401(k) loan.

Apparently, the greatest hurdle to have first time homeowners when planning to get a home is picking out the cash to meet the fresh new deposit. If you have been adding to the 401(k) because you already been doing work, it is far from unusual that harmony in your 401(k) package would be their prominent resource. If the right chance occurs to buy a home, it could is sensible to take an effective 401(k) financing to come up with the newest deposit, in place of prepared the extra ages that it perform try establish a downpayment beyond their 401(k) account.

Caution with this particular alternative. After you borrow funds from your own 401(k), the take-home shell out could be faster from the amount of brand new 401(k) financing money over the duration of the borrowed funds, and after that you tend to a bring the latest homeloan payment above of this once you close into the new home. Undertaking a formal finances before which choice is extremely necessary.

Financing First off A business

We have had website subscribers you to made a decision to log off the corporate community and commence their company but there is however always an occasion pit between once they already been the business of course, if the company actually begins making money. It is therefore this option of one’s first pressures for entrepreneurs is trying to discover the money to discover the team up and running and have now cash self-confident whenever you’ll. As opposed to attending a bank for a loan otherwise increasing money from family and friends, when they got a great 401(k) employing former manager, capable to setup a solamente(K) plan compliment of their new organization, rollover the balance within their the new Solo(K) package, just take a beneficial 401(k) mortgage using their the newest Solo(k) plan, and employ one financing to run the company and pay the personal expenses.

Again, word of caution, starting a business is high-risk, hence means concerns spending money which was arranged having the new retirement decades.

Your bank account May be out of The market industry

When taking that loan from your 401(k) membership, those funds is removed for your 401(k) membership, following slower repaid across the time of the borrowed funds. The money that has been lent away is no longer getting financing come back in your advancing years membership. Even though you is actually settling you to definitely matter through the years it can enjoys a big impact on the bill that’s on the membership within old-age. How much? Let’s evaluate an excellent Steve & Sarah example: