To acquire a house try a cornerstone minute in everybody’s lifetime. The fresh new pure immensity out of conclusion, the pleasure of experiencing something you can name their and you may the security it will bring makes having your family an invaluable experience. But in the current field property rates is actually exceptionally high and you can and then make right up grand financials will be a daunting feel. Away from choosing the perfect destination to securing financial support, of a lot moving pieces circulate the home-to buy cogwheels. But with the proper suggestions and you may service, to order a home will likely be a mellow and you will straightforward techniques. This is how we have: as one of India’s best banking companies ICICI payday loan Aventura Financial also provides numerous Family Financing options to help people make the correct ilies.

Regular Home loans: We offer these Lenders to people for purchasing an alternate house and for the construction of yet another household

In the ICICI Financial i have customized all our Mortgage choices to make it easy for customers to get otherwise construct the fantasy home with aggressive interest rates and flexible fees solutions. Our very own factors as well as focus on dynamic customer demands. Whether you’re an initial-go out homebuyer or trying to change your latest domestic ICICI Lender features Home loan choices that meet your needs.

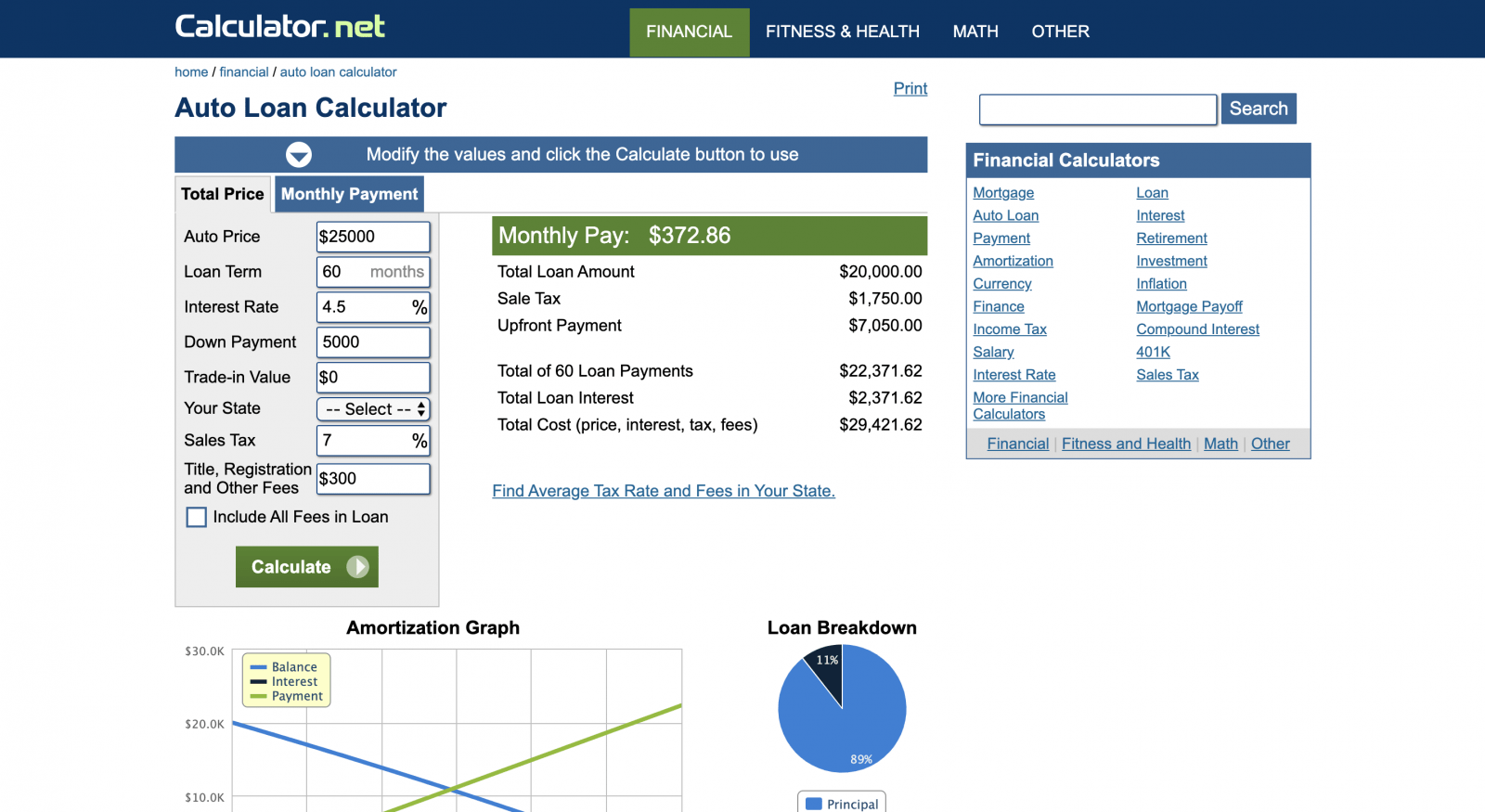

The Financial process with ICICI Bank is as straightforward as it gets. Once you get clarity on your eligibility, use the Mortgage calculator and get an estimate of the monthly EMI payments you’ll have to make over the repayment tenure. The Home Loan calculator takes into account the loan amount, interest rate and loan tenure to give you an accurate estimate.

Then you can go to submit an application for the loan online of the filling out the application and you will offering the necessary files. ICICI Bank’s expert software processes will additionally let us read the application at a fast rate and you will get the amount borrowed for the close to virtually no time, shortly after acceptance was gotten.

Our house Online calculator is a fantastic product that helps you create an informed choice regarding your Financial requirements and you will readily available possibilities. You’ll be able to track down an estimate of the month-to-month EMI costs which will help your influence the brand new value of your financing. The new calculator and additionally makes you examine some other loan options and you will buy the one which is best suited for your circumstances.

Within ICICI Lender we offer a selection of Mortgage activities to fit different consumer needs. Here are a few of the home Financing choice searching at:

1. The interest costs for those financing depends upon the loan amount and you may tenure and you can users can also be get up to 75% of the home really worth as a loan. You are able to submit an application for a mortgage right here towards our webpages. You might check out the nearby ICICI Lender Part to submit the application.

2. Top-Up Money: This type of funds are supplied so you’re able to people whom curently have a current Mortgage having ICICI Lender and need some most funds to own house renovation otherwise expansion. Every possessions enterprise in Asia be it to shop for or remodeling has the possibility of overshooting the first funds. Losing quick will not stop you once you partner with united states. These fund are also available in the aggressive rates and certainly will become availed instead most papers.

You can begin procedures by the checking the eligibility for the ICICI Bank Home loan webpage

step 3. Step up Home loans – ICICI Lender Part of Lenders is entirely tailored for brand new more youthful salaried Indian. With this specific financing you could potentially avail of a higher amount borrowed than simply you can regarding your loan qualification to possess normal Mortgage brokers. In addition regarding initial many years you just need to pay moderate EMI numbers to help ease the new monetary strain.

4. House Financing: If you find yourself just looking to purchase certain residential property because another money you can aquire an area Mortgage off all of us in the exact same appeal once the our very own regular Lenders. The mortgage matter and qualification requirements varies.

You may here are a few our home Overdraft: one cure for all your valuable funding criteria. These multi-purpose enough time-tenure options will help you do both structured and unexpected costs. In case you’re in search of mortgage repayment pricey, i also have a home loan Harmony Import facility one lets your transfer your a good mortgage to a different lender that will bring your better cost. If you find yourself currently settling that loan that’s heavier on your own pouch you’ll have the fresh outstanding count transferred to us on a good repo price-established aggressive attract. This is exactly accessible to anybody who desires to clean out the financial obligation load.