Just like the a gold Coast homeowner, you are sure that you to definitely selecting the most appropriate home loan would be overwhelming and you can perplexing. We would like to make sure to choose the best choice for your financial situation and you may upcoming needs. We realize one to going for anywhere between a fixed rates and you will varying rate financial might be an emotional and you can overwhelming decision. That is why we try to make certain our clients are given towards factors and you can info needed seriously to generate a knowledgeable choice regarding their financial possibilities.

Now, we go through the decision of many Gold Coast people deal with when taking right out home financing: whether or not to favor a predetermined otherwise variable interest. In this article, we will speak about the huge benefits and cons of every alternative and supply rewarding skills to aid clients generate an informed choice. We shall and answer faqs to include an intensive publication in order to choosing ranging from repaired and you will changeable rates lenders in australia.

Fixed Speed Home loans

Fixed speed home loans are one of the preferred household loans for the Gold Shore and you will round the Australian continent. A fixed price financial provides an appartment rate of interest to own a decided several months, constantly ranging from 1 and you can 5 years. The main advantage of opting for a fixed home loan is that you will be shielded from any grows in the industry cost with this several months. This means the month-to-month repayments will stay an identical no matter what what takes place towards rate of interest environment.

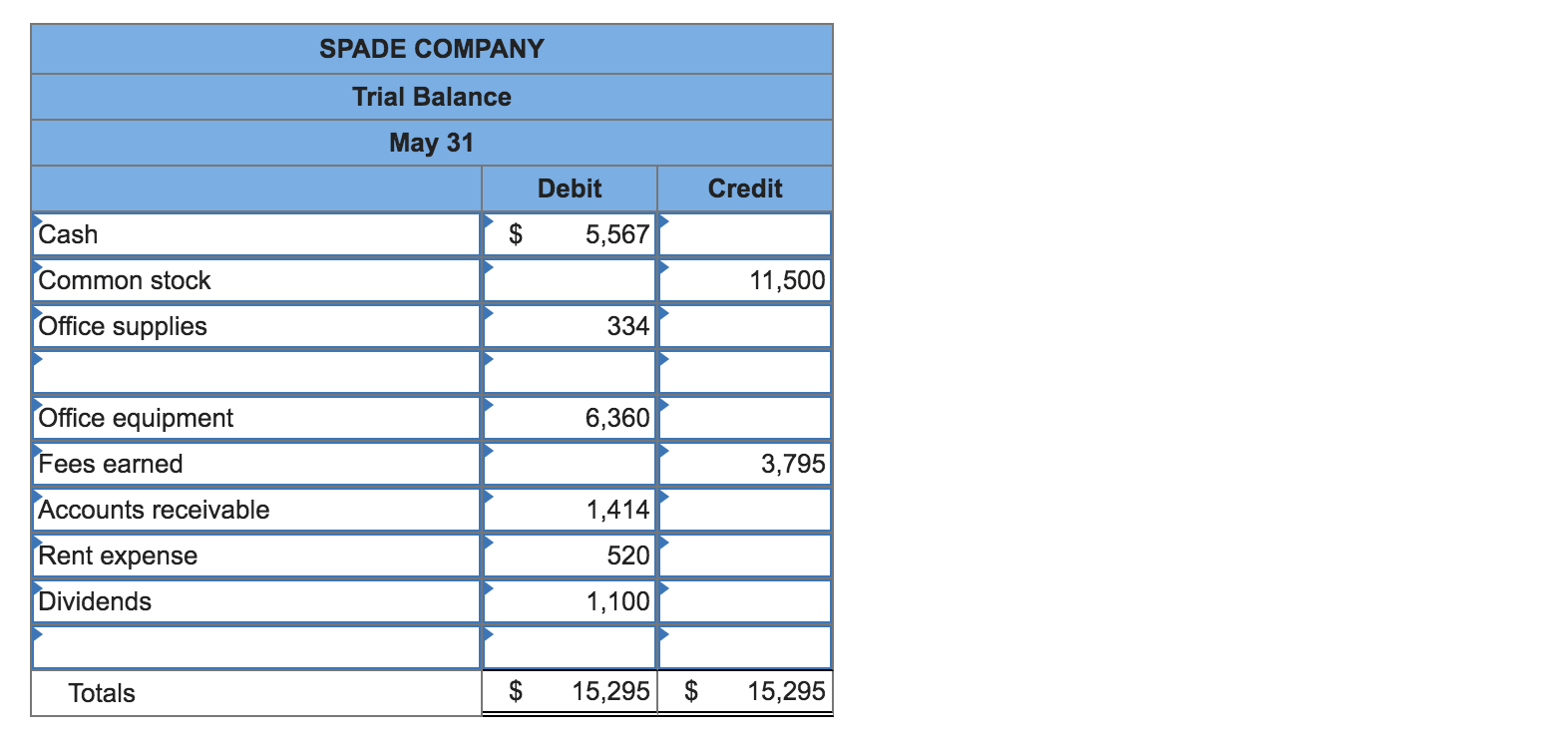

According to , considering a $five hundred,000 financing for 30 years, you are going to spend anywhere between 5.29% and you may six.64% attention on the fixed rate mortgage brokers, with respect to the provider.

Benefits of Fixed Rates Mortgage brokers:

- Confidence out of payment: that have a fixed speed loan, you will understand how much your own payment might be monthly, allowing you to funds and you will plan accurately.

- Protection facing interest rate goes up that have a fixed rates mortgage, you won’t end up being impacted by any grows regarding interest ecosystem.

- Easier to finances fixed rate money help you package and you can take control of your money, as you know what the repayment amount would be each times.

Drawbacks out of Fixed Speed Mortgage brokers:

- Large rates than the varying pricing: repaired rates finance will often have high rates than simply changeable price funds, that will increase Timnath loans the total cost from borrowing.

- Minimal freedom: after you’ve chose a predetermined mortgage, the choices for additional provides otherwise transform are limited up until the end of the fresh fixed period.

- Penalty charge for early fees: if you opt to repay the loan before end from the latest repaired period, there might be punishment fees charged by the bank.

If you’d like the security out-of a fixed speed financial, contact Grow Advisory Class. We’re going to find the correct financial to help you top meet your needs.

Variable Speed Home loans

Needless to say, should you choose not to ever fit into a predetermined price house mortgage toward Silver Coastline, you might decide for a changeable rates mortgage. Because the title implies, such financing is interested price that may changes over time according to field actions. Thus month-to-month repayments may also vary according to just what goes wrong with interest rates.

Predicated on a good $five hundred,000 loan to own thirty years, you might currently anticipate paying anywhere between 4.99% and 5.38% focus with the repaired price home loans, with respect to the merchant.

Advantages of Variable Rates Home loans:

- Down interest levels: compared to the fixed loans, varying financing generally have all the way down rates, making them even more pricing-productive full.