The us Agency out-of Farming (USDA) is not just in the beef monitors, additionally, it also offers a home loan program one to, with respect to the department, aided more than 166,000 family discover their house possession ambitions from inside the 2015 alone. The new USDA Outlying Creativity Solitary Household members Housing Financing Verify Program, otherwise USDA Mortgage, also provides numerous perks you won’t pick together with other financing software. Homebuyers have used it government-supported system given that 1949 to invest in homes it did not afford by way of old-fashioned pathways by taking benefit of its tall masters.

Zero Advance payment

The greatest, most obvious advantageous asset of a good USDA mortgage ‘s the no down-payment needs. Which conserves home buyers a substantial amount of initial money, which may be ideal test so you’re able to owning a home. Most other low down payment possibilities want limited quantity you to generally speaking start in the 3%, but with USDA finance you take advantage of zero-down on that loan equal to the brand new appraised worth of the newest home becoming purchased. The capability to obtain 100% investment is the most cited benefit this option will bring.

Lenient Applicant Qualification Requirements

Money are offered for individuals which have low fico scores as well as derogatory borrowing from the bank points or limited credit records payday loan Midway City may well not hurt your own qualification to possess a mortgage. The fresh USDA has actually versatile credit requirements versus other kinds of loans. Candidates only need a get regarding 640 to have automated acceptance, however, down fico scores are occasionally approved which have By hand Underwritten money, that have more strict standards. New USDA plus has no need for a minimum a career records throughout the exact same employment. Yet not, you will do you need evidence of steady earnings to the earlier two decades, particularly if you’re underemployed, owing to tax returns.

Reduced Month-to-month Private Financial Insurance rates (PMI)

Regardless of the mortgage program, people financing having below 20% down-payment is required to carry PMI. But not, PMI is significantly cheaper with a USDA financial and you may is referred to as verify fees. These charge tend to be an initial and you can annual charge. Another advantageous asset of an excellent USDA financial is this type of fees comprise a low PMI speed of every mortgage program. Currently, the new initial commission is actually 2% and also the annual payment is actually .50%, but these are prepared so you’re able to , predicated on home loan professionals such Inlanta Mortgage. A holiday work with ‘s the capacity to fund their upfront PMI by the running it to your investment, so you’re able to romantic in place of putting anything off.

Competitive Annual percentage rate (APR)

Your own zero-down payment USDA home loan does not mean you’ll be able to pay a high Annual percentage rate. These financing promote similar, if not down, rates than you’ll find having conventional fund or any other specialized family mortgage applications such Government Casing Expert (FHA) fund. Because these loans was protected because of the government, loan providers promote low interest that wont differ predicated on the advance payment or credit history, while they create which have traditional money. You take advantage of 15-year and you can 29-season fixed interest rates one rival this new prices out of most other reduced-interest reduced applications.

Reasonable Monthly installments

Due to the no-deposit, you wind up which have increased financed harmony that have USDA financing, but it’s commonly counterbalance by the all the way down, less costly PMI and e, or either down, than many other financing possibilities, which particularly advantages family members towards tight spending plans.

Numerous Area Availableness

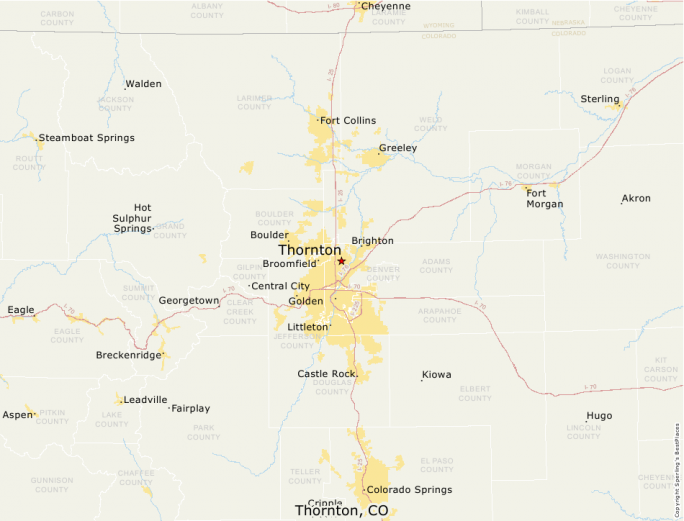

Once the financing are specified getting “rural” components, the fresh USDA concept of outlying is actually liberal. According to Financial Statement, on the 97% from end in the brand new You.S. is approved. Basic recommendations condition possible properties must be in section having an effective people less than 10,000, otherwise 20,000 within the parts considered to have a critical insufficient home loan borrowing from the bank to possess all the way down/moderate-money family members. Rural classifications aren’t expected to alter until 2020. Of many suburbs of metropolises and brief urban centers fall on these direction. A majority of areas all over the country has many area deemed rural and most external sleeping regions of the largest metropolises. Eg, Allentown, PA is just too highest in order to meet the requirements while the an eligible rural area, however, quicker boroughs during the Lehigh County, such as Coopersburg perform. Get an over-all idea of accredited metropolises by the consulting good USDA eligibility map and ensure whether particular land meet the requirements using your financial lender.

Contemplate, this new USDA doesn’t funds your own home loan. It partners having approved loan providers who are ready to create loans that have attractive terminology in order to qualified individuals having a fees be certain that of the latest Rural Creativity Home loan Verify Program. When you’re there are many great things about a good USDA home loan, you might be nonetheless at the mercy of all of the qualifications conditions of one’s system, therefore not everyone usually qualify.

If you purchase something otherwise create a merchant account because of an association on the our very own webpages, we might discovered payment. Using this website, you say yes to all of our Representative Agreement and agree that the clicks, connections, and personal information can be obtained, registered, and/or stored by the you and you may social networking and other third-class partners according to our very own Online privacy policy.

- The Privacy Choices

- | Affiliate Contract

- | Ad Choices

Disclaimer

Access to and you may/otherwise membership on the one percentage of your website constitutes invited off all of our Affiliate Arrangement, (current 8/1/2024) and acknowledgement of your Online privacy policy, as well as your Confidentiality Choices and Rights (updated step 1/1/2025).

2024 Get better Local Mass media LLC. Every legal rights kepted (About You). The material on this website is almost certainly not recreated, marketed, sent, cached otherwise used, except on past composed consent out of Improve Regional.