step one. Look at your borrowing from the bank

Everything on that statement will your once you chat to their financial officer. It is preferable for taking a glance at their borrowing once most of the one year to be certain there are no inaccuracies on your report.

2. Rating mortgage pre-approval

Second, choose which home loan device is an educated fit for your needs, after that store some other loan providers observe one that comes with the best conditions. Lenders will be such as for instance of good use right here, because they work with numerous loan providers, and you may store your loan around to find a very good offer.

To obtain the formal pre-acceptance letter showing providers youre a serious visitors, you’ll want to tell you these data files:

- Two years out-of W2s

- Pay stubs for the past a few months

- Lender comments over the past a couple months

- 2 years property value tax returns

- Profit-and-loss statements to have care about-working some one

- Case of bankruptcy otherwise separation paperwork (when the relevant)

Acquiring the pre-recognition page is a crucial part on the process. It creates one provides you with build into possible belongings much more strong, as it suggests that debt information have satisfied the minimal criteria required by your own lender, and you can barring any issue during underwriting, you’ll likely become recognized to possess capital.

step three.Get a hold of a realtor

Discover an excellent agent that is competent within operating which have first-date customers close by. Your own mortgage broker on a regular basis works with tons of additional agencies, in fact it is trained on which of these know their target community better. First-time people, pros, and you will higher-avoid home buyers tend to appreciate this brand of expertise in settling agreements.

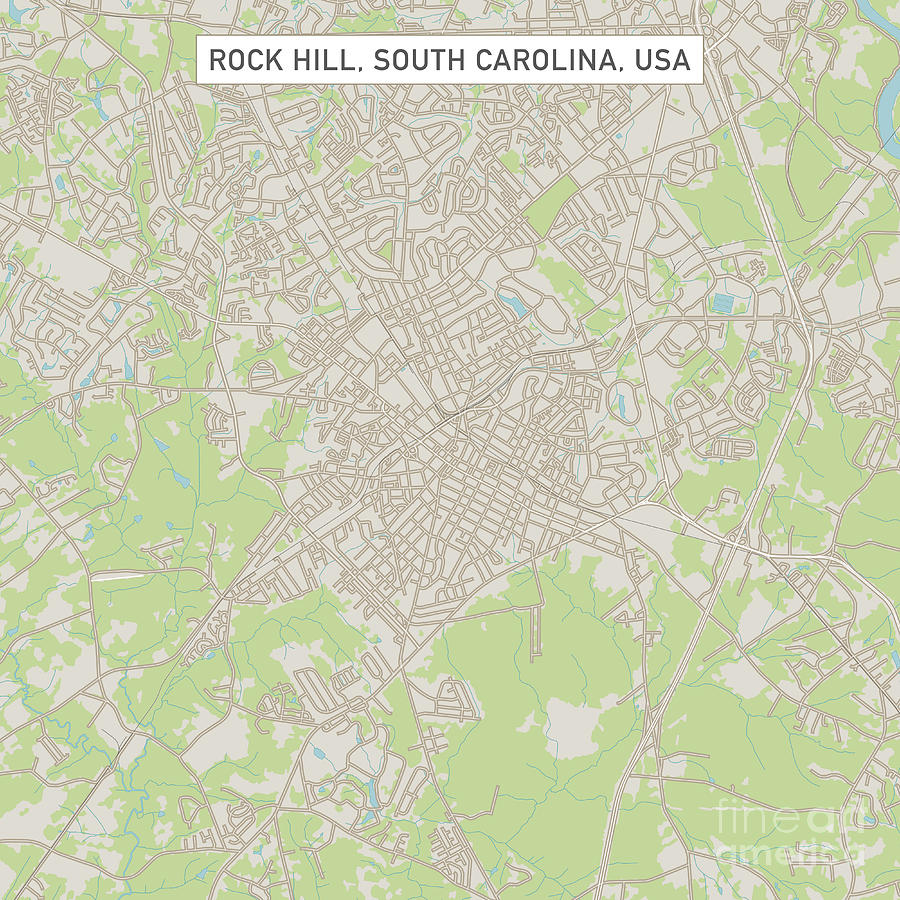

4. Narrow down your location

Ultimately, ahead of time searching, restrict the area you want to inhabit. Believe things affected by place instance:

- distance working

- exactly how romantic you are into the features you like

- quality of neighborhood schools (even though you lack kids)

- future developments otherwise city believed

5. Pick your next home

Incorporate home applications or any other of good use equipment to remain structured, and you will search home prices in the area. Contemplate, this might be perhaps not the final household you are able to individual. It’s a start, and you may a stepping stone to create the next equity for the.

Maintain your property demands against. desires number in your mind as you shop, to help you optimize your to buy energy and keep maintaining standards inside the have a look at.

six. Build a deal

After you look for a house you love, your own agent will help you generate a deal. The deal will inform the conditions on the domestic get, the sort of loan you are going to explore, and you will any vendor concessions you’re requesting.

Their real estate professional helps you decide when it’s wise to ask to own seller concessions, of course, if it’s a good idea to go out of them out, with regards to the heat of housing market, and you will quantity of most other offers the domestic have.

Owner then has got the solution to take on, deny otherwise bring a great counteroffer. Commonly you will go back and you may ahead several times with the seller before you can reach a contract.

eight. Your own provide was recognized

Once you therefore the vendor arrive at an agreement as well as your offer was officially approved, youre sensed within the bargain.’ You’ll put a date so you can sign up brand new dotted line and you will romantic the deal.

8. Financing underwriting and you can Checks

This is the time having underwriting, appraisals, and inspections. There’s a lot of waiting around during this period, plus it may appear like there is nothing happening possibly, however, a lot is going on behind the scenes to operate a vehicle your loan owing to.

TIP: Pose a question to your financial advisor regarding do’s and loan places Mechanicsville you can don’ts out-of escrow, and that means you don’t eventually ruin your home financing through an excellent flow your own lender wouldn’t approve out of.

nine. Romantic escrow

Given that closing big date nears you’ll render money having one settlement costs and you may deposit necessary for your own lender, and indication the official documentation to take possession in your home.

Once you signal the borrowed funds documents having a good notary, your lender tend to meet one history remaining criteria and your document would-be put-out so you’re able to listing into the county. Since the file are filed towards condition, you are theoretically a resident!

10. Agenda an appointment.

It’s as easy as arranging a simple phone call otherwise interviewing our financial advisors. Within minutes, you’ll know what you could afford, and the ways to go ahead.