The foreclosures techniques and you can small marketing techniques connect with buyers instance you

If you’re in the market for a house however, interested in an effective way to save very well which major pick, you happen to be offered purchasing a foreclosures otherwise an initial selling. Navigating the new small sale techniques and the property foreclosure processes can be a little tricky as a result of the files inside it. Given that residence’s current manager is within a difficult finances, you will find even more steps in the borrowed funds process. However,, if you work with a real estate agent proficient in this type of types of purchases, buying one ones characteristics can also be show large savings. Find out the variations when purchasing a primary marketing against. a foreclosures to help you expect you’ll navigate the procedure.

The brief purchases process starts in the event the latest proprietor understands he or she’s going to struggle to repay the loan inside the full. The proprietor following negotiates together with his otherwise their particular financial to just accept a lower rates for the family. This is exactly a state entitled pre-foreclosure. You could start seeking residential property within the pre-property foreclosure online, publicly information or by handling a representative who’s proficient in the fresh short product sales techniques.

Make sure you tour the brand new readily available qualities just as you might if perhaps you were to purchase property that was maybe not a primary revenue. At this time, you will additionally would like to get your own financial pre-acceptance in order to ensure you’re willing to fill out an offer once you see a house you find attractive to purchase.

As the owner accepts the provide, the lender has to get a hold of evidence of monetaray hardship throughout the current proprietor so you’re able to invest in an initial profit. Owner often fill out what is actually known as a hardship page one contours each of their unique profit to support the newest claim that she or he can not afford to spend the essential difference between your own promote together with full value of the house. The financial institution may also want to see financial statements and other data supporting that it claim.

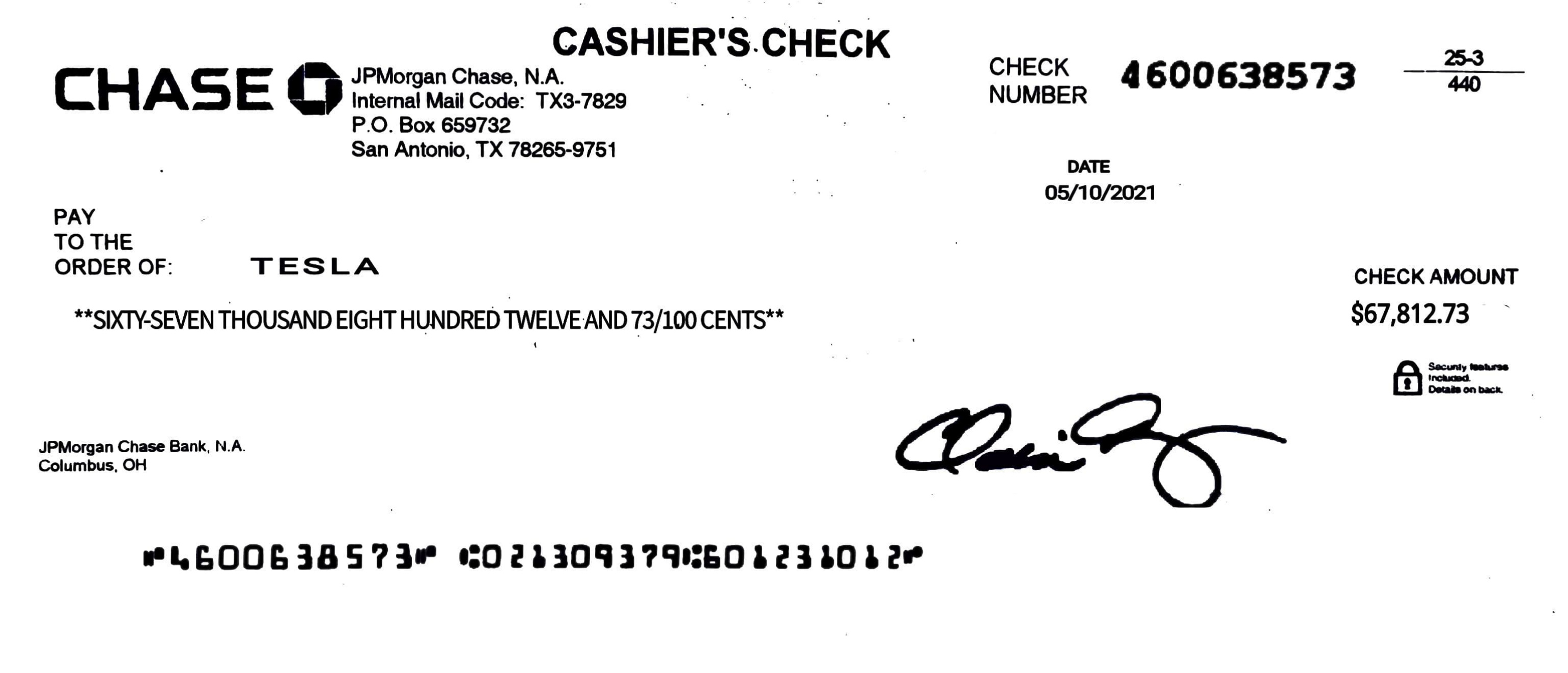

In case the bank believes so you can proceed with the small selling processes, you can easily finish the lender’s paperwork, proving which you have your financing in order, new serious money on hands and you can a downpayment. You want a whole lot more earnest money or a bigger advance payment for a primary sale than simply you might to possess a non-small marketing. (Because current proprietor turned out to be a card exposure, the lender look to own a buyer with way less exposure.)

Upcoming, you’re going to have to loose time waiting for this documentation to track down processed. Generally speaking, small conversion process simply take several months in order to closepare which for the traditional process, where you are able to close-in a couple of days. Certain lenders might have small marketing committees or at least of several inner procedures. Thus, have patience and often sign in on strategy to feel sure everything is continuing effortlessly.

Purchasing a foreclosures assets

The newest property foreclosure techniques on the a home is triggered whenever a debtor actually non-payments towards mortgage, meaning brand new borrower concludes paying their monthly financial expenses. In contrast, brief sales occurs before that point. Generally, the new foreclosures process begins three to six weeks following the first missed mortgage repayment. Since the domestic goes into foreclosures, the home is placed upwards getting public auction of the bank.

Generally speaking, the present day lender loans Ranburne AL often find the possessions on auction after which put it on the market since the-are. Up until now, your house is named a bona-fide house owned possessions, or REO. To obtain a beneficial foreclosed assets, inquire the financial institution getting a summary of REO functions. Buying the house right from the fresh public auction isn’t always recommended to possess a few factors. For one thing, inexperienced people tend to overbid while they aren’t accustomed this new market procedure. Subsequently, the newest house’s latest owner is probably still-living indeed there, and eviction procedures will have to initiate.

For this reason you need to function with new lender’s a number of REO qualities. Once you choose one you’re interested in to get, sort out the financial institution add a mortgage software. Just remember that , since these properties can be bought because the-was, you should be happy to manage something in the home that’ll not getting fixed or current ahead of your purchase.

Manage a skilled real estate professional through the property foreclosure and you may brief profit process

Navigating the newest foreclosure otherwise quick business processes can be a challenging activity on inexperienced. Whenever you are everything is personal, recording they down ranging from lenders, court records, and representatives can be numerous performs. Simultaneously, it is very important you follow deadlines and you can follow through vigilantly towards documentation. Missing one step you will definitely slow down your application.

You need a skilled broker to not ever merely help you would the method as well as offer advice. Particularly, during the early degrees, they might counsel you on the installing a deal that is reasonable. Become cautioned one to putting in a bid within these house can be competitive.

Find out about to purchase a primary deals versus. foreclosure property

The procedure of to invest in a preliminary sales or foreclosed home is novel every time, so you will most certainly have enough questions. Make sure you work directly that have a people Lender mortgage mentor you understand the processes every step of one’s ways. Simply phone call step one-888-514-2300 to begin, otherwise discover more about some Citizens home loan solutions.