Va Money provide self-reliance of closing costs, and that is included in owner, the lender, or even paid off by the homebuyer as part of the financing. These fund in addition to reduce quantity of settlement costs and charge loan providers may charge, then securing the client from extreme expenditures.

To be eligible for a beneficial Virtual assistant Mortgage, candidates need certainly to see certain services requirements, such a certain length of services in the armed forces, Federal Protect, otherwise Reserves. Qualification and additionally extends to some enduring partners regarding service users.

Va Fund was an important funding for those who have served throughout the military, offering an available road to homeownership also versus a high credit get or even the capability to make a huge down payment. The mixture from versatile borrowing from the bank conditions, zero advance payment, or other customers-amicable keeps build Virtual assistant Fund a great option for eligible veterans and provider users thinking of buying or re-finance a house .

USDA Fund

These finance, supported by the united states Service out-of Agriculture , are designed to promote homeownership in shorter urbanized portion, supporting the development and you will sustainability out of rural teams.

Such Virtual assistant Fund, USDA Financing try not to strictly impose the absolute minimum credit rating, getting extreme independence getting potential housebuyers. This method aligns with the program’s goal of to make homeownership far more easily obtainable in rural areas.

However, a credit rating of 640 or more often is suitable for a streamlined loan handling experience. Homeowners which have score in this diversity are generally qualified to receive the newest USDA’s automatic underwriting program, that may expedite new recognition process. Getting individuals with scores below this endurance, a handbook underwriting process required, and that’s more hours-sipping and you will relates to an even more comprehensive examination of the brand new homebuyer’s borrowing record and you can economic character.

USDA Money have become very theraputic for qualified rural homeowners on account of the good terms and conditions. One of many gurus ‘s the possibility of 100% financial support, definition eligible homeowners can obtain financing in place of a down-payment.

Such funds usually incorporate faster financial insurance costs versus Traditional and FHA Fund, causing straight down monthly obligations and and also make homeownership cheaper. USDA Financing also are recognized for the generally competitive rates, then improving their https://paydayloancolorado.net/redstone/ attract the individuals thinking of buying residential property within the outlying components.

To qualify for a great USDA Mortgage, the house or property must be based in an area appointed while the outlying by USDA. Potential homebuyers can be take a look at qualification regarding certain cities into USDA’s webpages .

Candidates also needs to fulfill particular income limitations, varying by the area and household dimensions. Such restrictions are set to be sure the program provides people who really need assistance for the getting homeownership. Other important criteria include You citizenship or long lasting abode, a steady income, and you may a reputation responsible borrowing from the bank play with, even when the credit score is actually below the required 640.

USDA Financing provide a great path to homeownership of these lookin to reside rural portion. As they don’t strictly wanted a high credit history, targeting 640 or a lot more than is clarify and speed up brand new loan procedure.

Knowing the novel pros and requires out-of USDA Finance is essential for all the potential homebuyer offered property for the an outlying area.

Lender’s Direction on the Fico scores

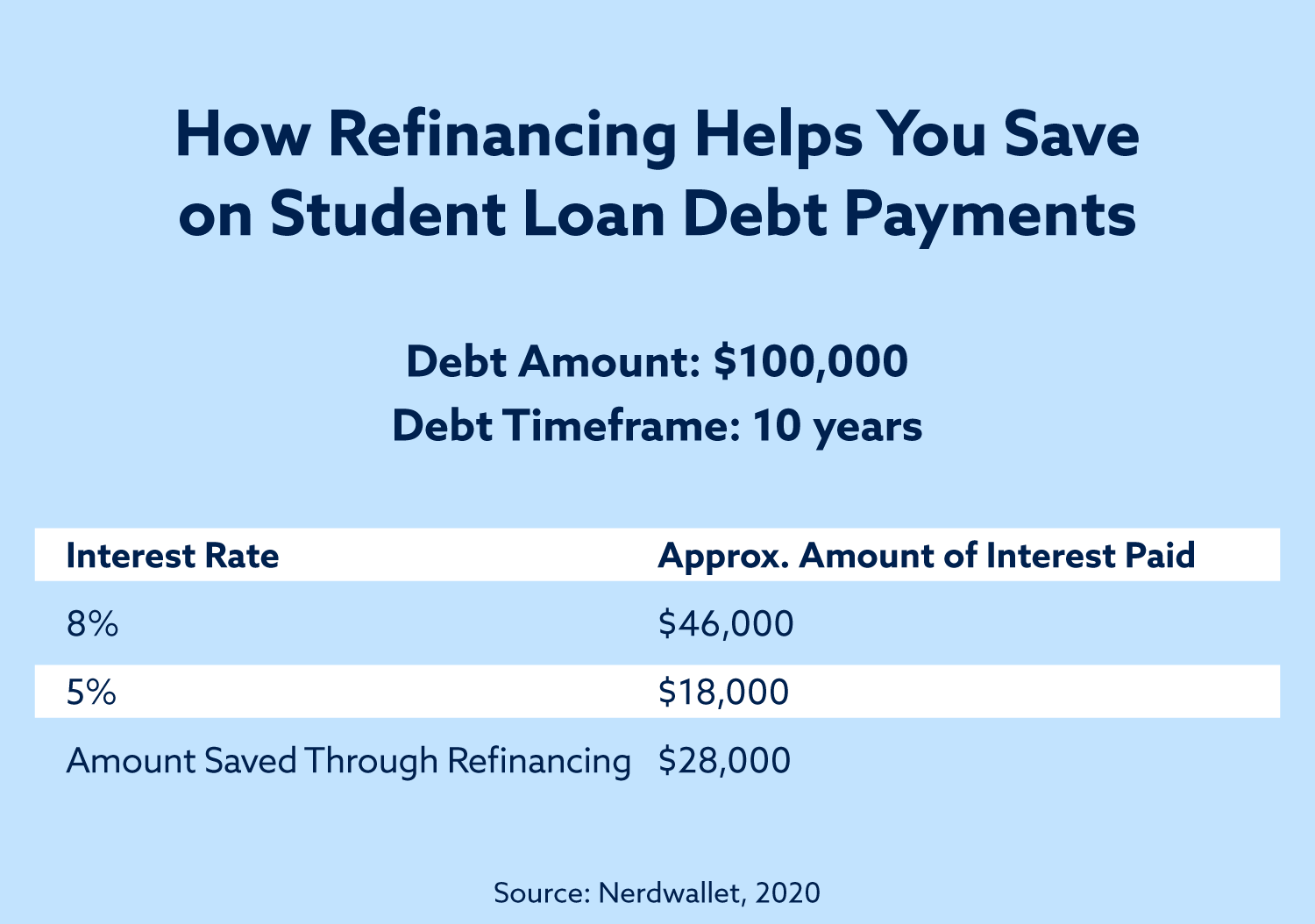

Mortgage lenders use your credit history since the a first equipment to help you assess the threat of financing for your requirements. A high credit rating ways a history of in control borrowing from the bank administration, reducing the lender’s exposure and often translating towards the significantly more beneficial financing conditions, in addition to down interest rates and better home loan conditions. Concurrently, a reduced credit score might lead to high interest rates otherwise actually loan assertion.