At first it was effortless. I was a lawyer. He had been a professional. We generated about an equivalent paycheck. However I decided to briefly move to Texas to help work on a good CBD legalization promotion.

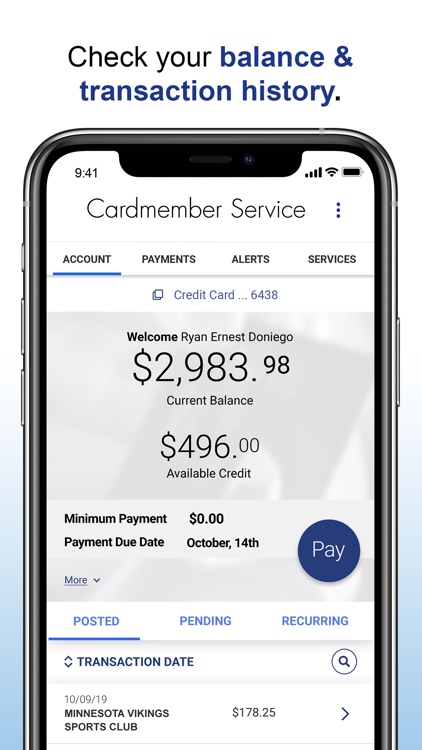

I took a cover reduce as it are thrilling as an integral part of records. However, excitement does not pay a few rents. That is when we been having fun with budgeting application – if you go for people system you want, the HerMoney fan favourite was YouNeedABudget (YNAB).

In advance of We left having Colorado, i spent time to your our very own budget, creating allowances each of our own fixed monthly expenditures and you may learning simply how much we can for each devote to discretionary expenditures. We knew we can generate our funds sensible whenever we factored in a number of autonomy having random things i purchase when we’re stressed, having a great time, or maybe just ready to pay money for comfort one to date – you to brief amusement category for each folks.

Generally, the two of us utilized our activities costs getting $step three java. Especially if you’re life style thus frugally, it noticed a and you will edgy to invest some guilt-totally free dollars damaging the information of any talk reveal economic agent.

Pregnancy, Difficulties and something Income

When i came back the home of Boston, it absolutely was a special event whenever we current our budgeting software so you can mirror one book costs as well as 2 top-notch-level salaries. That has been the plan, anyhow, up to afterwards one winter as i revealed I became pregnant – and you can a disorder titled hyperemesis gravidarum (a technical title having unrelenting disease) grabbed more me personally.

Another couple of months was a good blur. Approximately the hospital visits and vomiting, my husband gone us to a smaller flat therefore we you’ll do on one paycheck up to I returned to be hired.

To my personal second trimester, We arrived at feel a small best. But I nonetheless wasn’t performing, so we returned to our budgeting software’s business display screen and rewrote our costs to cover two-and-a-half people who have you to salary. We’d in order to scrimp, but i made new costs performs.

Initially, it failed to very happen to me which i is living off my wife or husband’s money. We proceeded and work out financial behavior together, and that i is staying with my personal budget and you will investing bills away regarding my membership as ever.

However, eventually in my third trimester, We visited pay my personal credit card expenses and pointed out that I didn’t have enough to cover my balance. It was next it basic struck me personally that there is always to getting unique monetary advice for sit-at-home moms who are not getting a full time income.

I did not features a paycheck coming. We envisioned him taking a look at the report and you will curious the newest Sephora fees. Manage payday loan Pueblo I need to inform you your the new Dior eyeliner I buy monthly? Let’s say he envision $29 to have good crayon is actually unrealistic?

Here’s what This Stay-At-House Mommy Performed

He informed me in order to email address him the quantity I desired. Therefore the next morning, We composed your a list of line items and numbers. We sensed adding a column to own my personal mastercard bill. Or even more unnerving, I sensed creating independent lines to possess everything you back at my credit card statement.

However, I ran across we’d currently undergone this course of action. We’d spending plans to own everything – and activities. Thus i added a line having Shaleen’s Activity Finances, totaled the list, and you can delivered it. An hour later a contact displayed myself that he had made the new transfer on my account and set an automobile-transfer for similar matter every month.

I didn’t features a flat plan for whenever I’d get back to operate, however, We thought you to definitely I would personally return relatively after new little one appeared. That is what I imagined – up to I unearthed that the costs out-of Massachusetts day-care mediocre far more than We purchased college or university ($16,000 a year). So i went on to keep house for a time.

After i turned into in charge of full-time baby care and attention, I never ever sensed self-conscious about perhaps not introducing a paycheck again – generally since the I did not have enough time feeling thinking-aware of things (evaluator no less than enable you to grab restroom trips; toddlers bust through the home shouting).

One quick, personal, no-questions-asked activity finance have desired us to maintain my personal financial dignity. Not just do that money go only on my personal desires and requirements, but have freedom over the best way to invest it.

Today I have become personal team because a recruiter, and that i think its great, even if investing in the organization will bring its very own group of complexities. Now, I’m thankful that people put up a collectively respectful budgeting system very early, but We nonetheless completely accept that there needs to be monetary guidance to own remain-at-home mom

On HERMONEY:

- A knowledgeable Cost management Tricks for Your own 20s and you can 30s

- Why we Be FOMO and the ways to Overcome It

- Would Women You want Big Emergency Fund Than Guys?