Entering the trail to pre-approval delves towards the significantly more detailed areas of an individual’s credit rating, where comprehensive checks you are going to briefly connect with their credit scores. It is an essential action that offers lenders a comprehensive picture out-of your financial situation. You should meets you which have an amount borrowed you to matches precisely as to the you can afford.

No matter if navigating this outlined procedure you will briefly reduce your quest to own homeownership, they reinforces the brand new stability of your own financial application by building it up on thoroughly vetted and confirmed financial pointers, to make certain one people future possessions acquisition lies in strong fiscal items.

Advantages of Pre-Acceptance

With an excellent pre-acceptance feels as though putting on an effective badge that displays your sincere notice and you can economic stamina. On aggressive housing market, in which house is desirable gifts, pre-accepted directs a definite message in order to vendors you sit as a serious customer that will swiftly and with certainty close the transaction.

Comparing Pre-Qualification and Pre-Recognition

Pre-degree and pre-recognition may seem synonymous, even so they serve some other opportunities into the acquiring a mortgage. Pre-certification feels like a simple pirouette, quickly setting something into the motion. Pre-acceptance requires cardio stage given that prominent moving, demanding comprehensive vetting of the lenders and exhibiting its even more serious top from connection.

Each step are tall in this economic dancing. Gripping their distinctive line of functions guarantees a seamless show. Imagine pre-certification for the starting count, and therefore gracefully leads around brand new crescendo of getting certified and you may becoming supplied pre-recognized condition-vital milestones on your own journey toward securing home financing.

And this Processes is actually Smaller?

Fast step is essential throughout the initially grade off seeking a property; and this, pre-certification is provided given that direct lender installment loans bad credit Oregon shorter solution. It is comparable to getting a show teach, swiftly hauling you against their 1st concern to putting on studies within as much as one hour.

On top of that, pre-approval relates to a far more thorough scrutiny process and will getting compared so you’re able to providing a long-length travels that can simply take a few days if not weeks to complete-especially if your debts gift ideas in depth information.

Degrees of Partnership from Lenders

On a property website name, lenders high light anyone who has achieved pre-approval more individuals who are just pre-certified. Pre-recognized applicants is viewed with highest esteem and you can recognized as a whole lot more reputable and major professionals of their money.

When deciding between pre-degree and you can pre-acceptance inside house-to get processes, you must envision an individual’s condition. Have you been merely entering your home see, otherwise have you been primed to plant their banner on the a selected possessions? Both techniques assist determine how much household a purchaser are able to afford, getting a better picture of affordability.

Pre-degree acts as an initial beacon on your own mining stage, enabling figure the newest trajectory of have a look. On the other hand, pre-recognition are comparable to equipping yourself to own battle throughout the fierce realm of bidding battles. It indicators unequivocal intention and you may preparednessprehending how being pre-certified vs. bringing pre-approval differs from just are alert as a consequence of an initial qualification can also be getting crucial for effortlessly navigating to the homeownership achievement.

Best for Very first-Time Homebuyers

Acquiring pre-certification can be told since a leading light for starters whom pick a property. It includes beginners having insight into their financial standing and you may molds the class because of their house-google search trip.

Good for Severe Consumers inside Competitive Markets

For knowledgeable homebuyers targeting the dream property, acquiring pre-recognition signifies he is the time buyers. It functions as defensive hardware inside aggressive real estate markets, where moving nearer to owning a home needs proper moves.

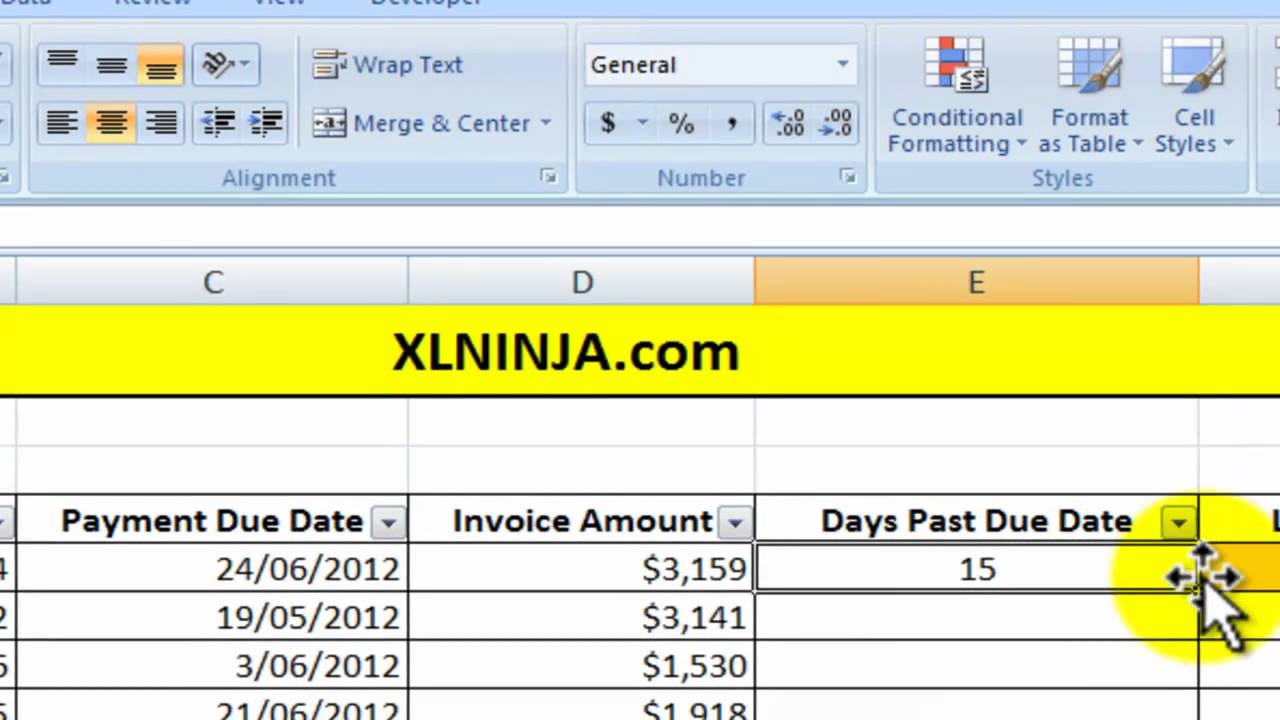

Ideas to Replace your Likelihood of Pre-Degree and Pre-Acceptance

When starting the road to mortgage prequalification or acquiring preapproval, it’s imperative to benefit from paths you to change your excursion. Consulting a realtor is rather increase chances of pre-degree and you will pre-approval giving a great preapproval letter to show evidence of resource. Having an effective credit history acts as a strengthening breeze, at the rear of you on the useful tourist attractions. Vigilant tabs on the newest dynamic mortgage otherwise credit card world hands your with degree essential taking over premium propositions whether your monetary things changes.