An element of many 401(k) preparations is the ability to borrow from oneself. Put another way, you can borrow funds that you contributed to their package, inside particular restrictions, and you will shell out yourself back.

He could be significantly more correctly named the capacity to access an excellent percentage of the later years plan currency-constantly as much as $fifty,000 or 50% of the assets, any kind of are smaller-into a taxation-free foundation. You then need pay back the cash you really have reached around legislation made to restore your 401(k) intend to up to the unique condition as if the transaction had maybe not happened.

Yet another confusing design in these deals is the label notice. One attention charged into the financing equilibrium try paid back because of the the new participant to your participant’s own 401(k) account, therefore theoretically, this is actually an exchange in one of your own purse so you can a new, not a borrowing from the bank expenses or loss. As such, the cost of an excellent 401(k) mortgage in your retirement coupons improvements are going to be limited, basic, if not confident. In most cases, it might be below the cost of using genuine appeal into the a bank otherwise unsecured loan.

Top 4 Reasons why you should Use out of your 401(k)The major five reasons to seek out your 401(k) getting serious small-term bucks demands was:Speed and you can ConvenienceIn most 401(k) arrangements, requesting a loan is quick and simple, demanding no extended programs or borrowing from the bank monitors.

Extremely preparations allow financing payment as generated conveniently as a consequence of payroll deductions-playing with shortly after-taxation dollars, whether or not, maybe not brand new pre-taxation of these capital your own package

Of a lot 401(k)s allow loan applications getting made with a number of ticks with the a site, and you will has financing on your turn in several days, that have overall confidentiality. You to creativity now-being followed by specific arrangements try an excellent debit cards, by which multiple money can be made instantaneously into the small amounts.

Cost Self-reliance In the event rules indicate good four-season amortizing fees agenda, for many 401(k) funds, you could potentially pay the plan financing less with no prepayment penalty. Your bundle comments reveal credits to the loan membership and your left dominating balance, just like a frequent bank loan declaration.

Rates Advantage There isn’t any rates (besides perhaps a small financing origination otherwise government percentage) to help you tap your 401(k) currency having short-term exchangeability demands. Here’s how they constantly functions:

Officially, 401(k) financing aren’t real fund, because they do not encompass either a loan provider otherwise an evaluation of the credit score

Your specify the fresh funding account(s) at which we should borrow funds, and the ones investments was liquidated for the duration of the mortgage. Ergo, you eliminate people positive money that would was basically created by people opportunities to have a short span. Whenever the market industry are off, youre attempting to sell this type of financial investments more inexpensively than just from the some days. This new upside is that you along with stop anymore capital losings with this currency.

The purchase price advantageous asset of an effective 401(k) loan is the same in principle as the rate billed to your a good equivalent personal loan minus any missing investment money on the principal you borrowed from.

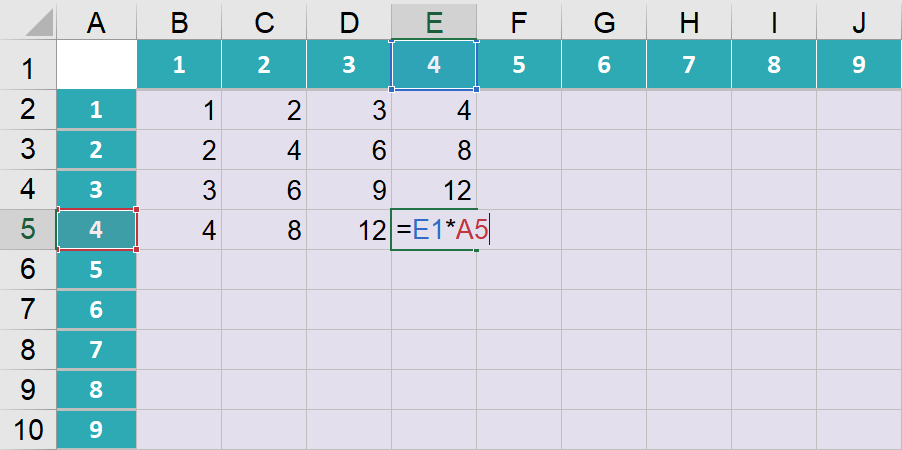

Imagine if you might take out a lender personal bank loan or get a cash online personal loans Arkansas loan from credit cards at an enthusiastic 8% rate of interest. Your own 401(k) collection was producing a beneficial 5% return. Your own pricing advantage getting borrowing from the 401(k) plan would be 3% (8 5 = 3).

Whenever you can estimate that cost advantage could well be positive, a plan financing might be attractive. Keep in mind that it formula ignores any income tax effect, that will boost the package loan’s advantage as personal loan notice is paid back having after-income tax cash.