Mortgage rates enjoys struck the reduced part of more a year and a half. And that is larger reports if you have been standing on the newest homebuying sidelines awaiting which moment.

Actually a small decrease in cost can help you rating good ideal payment per month than just you would expect on your own second household. In addition to lose that is taken place has just is not quick. As Sam Khater, Head Economist at Freddie Mac computer, says:

But if you want to see it to truly believe it, here’s how the latest math shakes out. Take a closer look within influence on your own monthly payment.

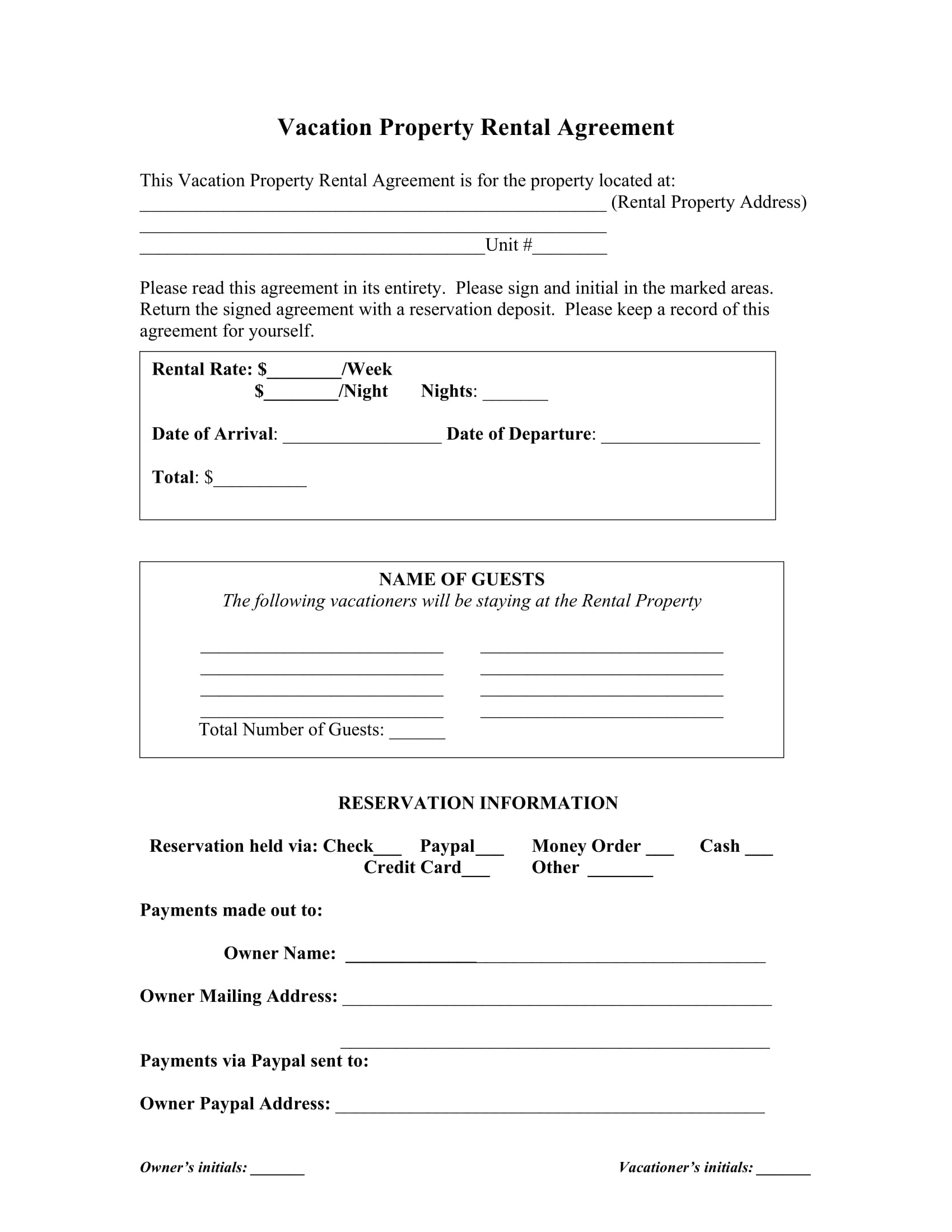

The latest graph lower than reveals exactly what a payment per month (dominating and you can appeal) carry out seem like into an excellent $400K mortgage for individuals who purchased property back to April (this year’s financial rates large), as opposed to exactly what it you certainly will appear to be if you buy a house today (select lower than):

Heading out of eight.5% just a few days in the past towards the low six%s has a giant affect your own conclusion. In just a few months’ go out, the latest expected monthly payment to your good $400K financing has come down of the more $370. Which is hundreds of dollars smaller four weeks.

Conclusion

With the latest drop for the financial cost, the brand new to find energy you really have today is superior to it’s experienced almost two years. Let us discuss your options and just how you may make the fresh new most of so it second you have been awaiting.

Copyright laws 2024 Washington Local Mls, Inc. Most of the rights kepted. Guidance Not Protected and may Getting Confirmed by end Affiliate. Site contains alive data.

When you find yourself contemplating to purchase property, your credit score is just one of the greatest bits of the mystery. Look at it like your monetary statement card you to definitely lenders look on of trying to find out for those who meet the requirements, and you may which financial will work right for you. As the Home loan Declaration says:

Good credit results express to loan providers that you have a song list to possess properly dealing with your debts. Ergo, the greater the rating, the higher your chances of qualifying to own a home loan.

The problem is extremely direct lenders for installment loans for North Dakota people overestimate the minimum credit rating it need to get a property. According to a report out of Fannie mae, just thirty two% regarding consumers have a notable idea out of just what loan providers want. That means nearly 2 out of each and every step 3 people don’t.

Minimal credit score wanted to pick a property vary off 500 in order to 700, but at some point count on the type of home loan you may be making an application for along with your financial. Very loan providers want a minimum credit score of 620 to get a property that have a normal home loan.

Although loan providers explore credit scores particularly Fico scores to simply help all of them generate financing decisions, for each and every financial has its own means, such as the amount of risk it finds acceptable. There’s no solitary cutoff get utilized by the loan providers, and there are numerous additional factors you to loan providers are able to use . . .

While your credit score means a tiny TLC, don’t get worried-Experian says there are lots of simple steps you might take to provide a boost, including:

step 1. Shell out Their Bills promptly

Lenders like to see that one may reliably pay their expense timely. For example everything from credit cards in order to utilities and you will cellular phone expenses. Consistent, on-big date costs tell you you may be a responsible borrower.

dos. Pay A good Loans

Settling your balance will help reduce your complete obligations and then make you a reduced amount of a threat to help you loan providers. Along with, they improves your own borrowing from the bank utilization proportion (simply how much credit you will be having fun with versus their total limit). A lesser ratio mode you will be much more legitimate to lenders.