Initially, it’s a simple mix up. Borrowing from the bank Unions and you may Finance companies one another give lending products and you may functions. They are both financial institutions one make money using charges and interest towards finance. But that’s where in actuality the similarity ends. Search greater and you might see tall differences. Let us begin by banking institutions.

What’s a financial?

Lender clients are that – people. Financial profits go to shareholders which own stock in the firm. Those people investors will most likely not have a free account toward bank it hold stock in.

Banking companies will likely be large or small, of multiple-federal so you’re able to local and you will neighborhood-centered. Small area banking companies normally promote products a lot more certain on the nations than the big banking companies; not, they have been still funds-determined organizations with investors in order to excite every quarter, and additionally they take advantage of charging late charges, came back view charges and better rates with the financing.

What is actually a cards Commitment?

Credit unions commonly-for-earnings cooperatives where clients are representative-customers. Just what which means was borrowing from the bank unions are essential to your neighborhood it serve. They have been influenced because of the a section regarding administrators comprised of volunteering member-citizens, who happen to be fundamentally responsible for the financing union’s monetary wellness.

Whenever you are proceeds earned by borrowing unions are lso are-invested in the day-to-time procedures, they’re also gone back to people in almost any means, eg all the way down charges and you can mortgage rates, together with higher interest rates towards the deposits therefore the expansion regarding twigs, ATMs, technical and you can features. Just what sooner produces credit unions various other, regardless if, is when they come for their members.

The brand new board and you can personnel have a beneficial vested need for your financial success, therefore it is popular for borrowing from the bank unions in order to machine family-to order workshops, savings courses, credit counseling, and at Seattle Credit Partnership, workshops of these trying to find becoming You.S. citizens. They have been introduce within local community situations, they roll-up its arm and give their some time and it mentor and service reasons their users worry about.

They may seem like banking institutions throughout the outside, however, borrowing relationship agencies have there been to assist, with your financial passion in mind.

Mutual Information

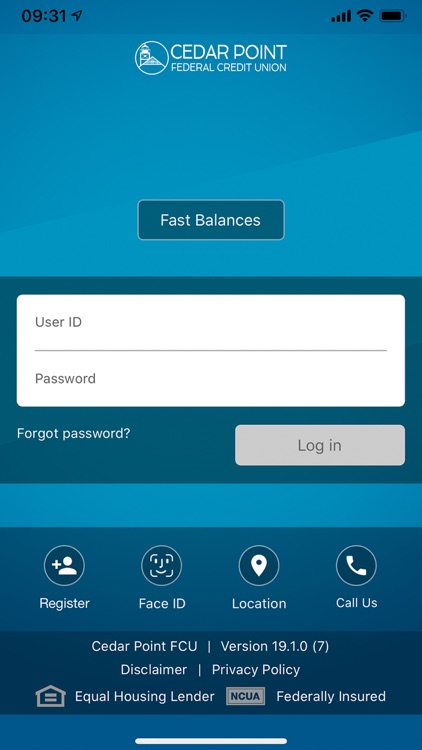

Some say they like finance companies on account of convenience, but borrowing from the bank unions target so it by creating common companies. It means borrowing from the bank relationship members are able to use the help of other credit unions free of charge, all over the fresh U.S. as well as in a number of acting countries. And more than credit unions try technologically smart nowadays, that have comparable on the internet and cellular functions toward large finance companies. Cellular financial, a relatively the answer to bank, has generated-in complete safety have in fact it is usually believed more secure than simply ATMs and other selection.

A small Records

Borrowing from the bank unions got their start in the early the main twentieth century because of the groups of people which common an association, such as for instance a group of team. Like, Seattle Borrowing from the bank Partnership is dependent during the 1933 because the City Credit Commitment to support City of Seattle group. Banking institutions during the time were less likely to financing currency so you’re able to people that did regarding the positions making choices subjectively.

Credit unions became formal included in Chairman Franklin D. Roosevelt’s Brand new Offer; the fresh new Government Borrowing from the bank Connection Operate try introduced into the 1934 to include oversight. During the 1948, the latest Bureau from Government Credit Unions (now brand new National Credit Connection instant same day payday loans online Washington Administration, or NCUA), is actually designed while the managing human anatomy. Borrowing from the bank partnership fund is actually covered, identical to financial institutions, but of the NCUA, instead of the Government Deposit Insurance rates Corporation (FDIC).

Signal Me personally Right up

Subscription is not difficult. Anyone which lives or work on condition out of Washington are an excellent Seattle Credit Union affiliate. For more information throughout the you, drop by a branch, contact us from the or click less than to become listed on now.