Lingering rising prices deceleration, a slowing cost savings and even geopolitical uncertainty can be sign up for straight down home loan prices. While doing so, investigation that indicators upside chance so you can online payday loans Oklahoma inflation can lead to large rates.

Advantages Can help Add up of it All the

When you you’ll bore down into every one of the things so you can extremely understand how it feeling home loan costs, that would be loads of performs. Just in case you’re currently hectic believe a change, using up that much learning and you may search may feel a little challenging. Unlike expenses your time and effort on that, slim into the advantages.

They mentor some body because of field conditions for hours on end. They’ll work with providing you a fast writeup on people wide trend right up or off, just what professionals state lies in the future, and how all that affects you.

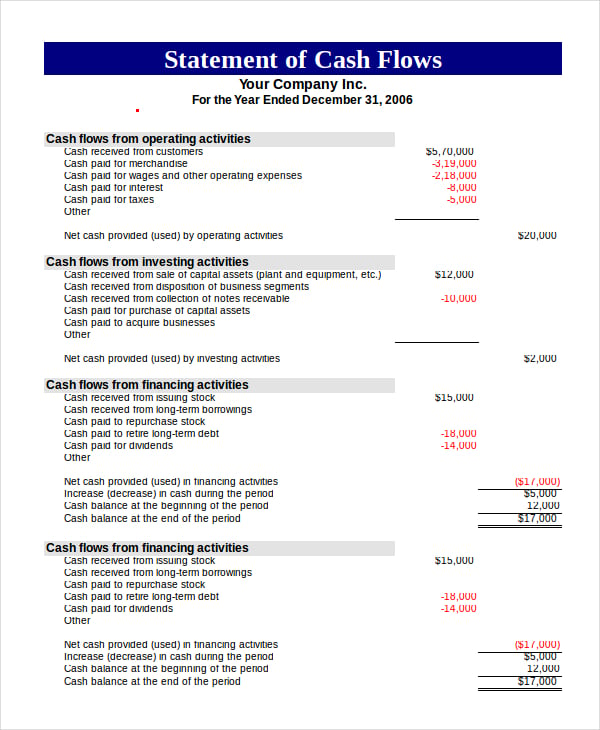

Simply take so it graph for example. It gives you a concept of just how financial pricing impact the monthly payment once you get a home. Consider to be able to build a repayment between $dos,five-hundred and $2,600 work for your finances (dominant and desire only). The environmentally friendly part regarding the graph reveals money in this range or straight down considering differing mortgage rates (look for chart below):

Clearly, actually a small shift when you look at the rates may affect the mortgage matter you can afford if you wish to sit contained in this one to address budget.

It’s devices and images like these you to definitely bring what you that’s taking place and show what it actually way for you. And only an expert has got the training and you may options must direct you compliment of all of them.

It’s not necessary to end up being a professional towards a residential property otherwise financial prices, you simply need to provides someone who was, with you.

Realization

Provides questions regarding what are you doing in the housing industry? Why don’t we hook therefore we usually takes what’s going on right now and determine what it simply opportinity for your.

Before making the choice to buy property, it’s important to plan for all of the costs you are responsible getting. While you’re active protecting towards down payment, don’t forget you’ll want to planning to possess settlement costs also.

What are Closing costs?

Settlement costs may be the charges and expenses you must shell out ahead of become the brand new court owner out-of property, condo otherwise townhome . . . Closing costs are different according to price of the property and exactly how its are funded . . .

This basically means, the closing costs is the additional charge and you may repayments you have making within closing. According to Freddie Mac, as they may vary because of the place and you will problem, closing costs usually tend to be:

- Government tape will cost you

- Assessment charges

- Credit history costs

- Lender origination charge

- Identity & Escrow services

- Taxation service charge

- Survey fees

- Attorney costs If you reside from inside the a legal professional state or employ a legal professional in purchase

- Underwriting Charges

Simply how much Are Closing costs?

Depending on the exact same Freddie Mac blog post mentioned above, they’re usually anywhere between dos% and 5% of the complete cost in your home. With that in mind, here is how you can buy a concept of exactly what you want to help you budget.

Let’s say you can see a home we need to buy within today’s average price of $384,five hundred. Based on the 2-5% Freddie Mac guess, their closure charges would-be anywhere between about $7,690 and you can $19,225.

However, keep in mind, if you find yourself in the market for a house a lot more than otherwise below that it budget, the closing costs will be highest otherwise lower.

Ensure that You happen to be Willing to Close

Because you start the homebuying trip, take the time to rating a feeling of all the will cost you inside from your down payment to help you closing costs.