It’s really no miracle you to definitely navigating this new homeownership trip can appear daunting. However, if you are a veteran or representative and qualify for new Virtual assistant mortgage, it’s you a fantastic pathway for the fantasy home here inside eden. This-by-action publication means the process and you will falls out some light on the The state Va mortgage process works, as well as provides reveal walkthrough of the Va home financing process and you can suggestions to improve it for your benefit.

Step one: Get Their Certificate regarding Eligibility (COE)

Your own journey begins by getting their Certification from Qualifications (COE). Brand new COE confirms to help you lenders you meet with the required services standards getting good Va mortgage. You can personal loans in Oakland get the COE through the VA’s site, or you can get in touch with we so we normally remove their COE to you personally.

2: Pre-certification

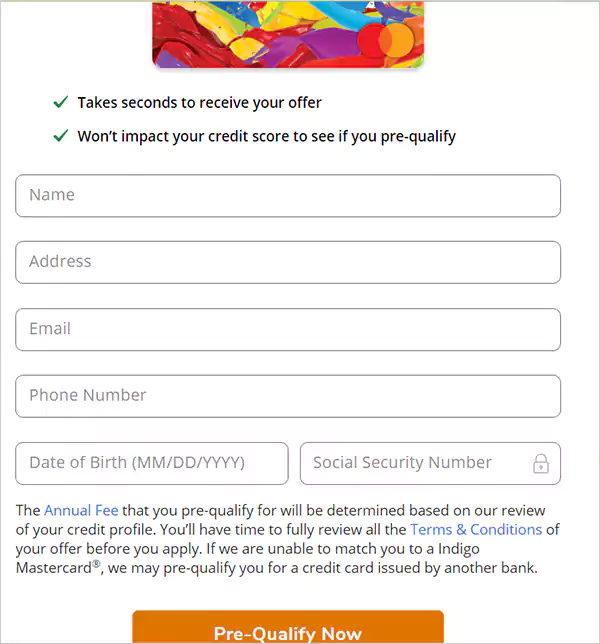

After acquiring your own COE, the next phase is prequalification. Its an initial research of your economy to judge how much cash you’re entitled to obtain. You sign up , give consent to get borrowing from the bank, and you will talk about exactly how much you are searching so you’re able to debtor with your lender. Bringing an excellent pre-qualification brings individuals a sense of just how much they can pay for, however in order to place an offer for the a home you you want over step 3.

3: Loan Pre-Approval

Second, is the pre-recognition phase. Bringing pre-accepted, means you may have filed a software and provided your mortgage elite support paperwork. The financial institution have a tendency to become familiar with all the information provided and you may ensure suggestions given throughout the application for the loan. An effective pre-acknowledged Virtual assistant consumer form providers is certain the new Va consumer can get no circumstances being qualified for a loan to the pre-accepted count.

Step: Household Query

Understanding how far you might use is essential so you can making certain your require belongings within your budget. Today, you are enable to go domestic hunting! During this period your own mortgage elite group tend to take a step back and you can works together with your realtor towards creating the brand new pre-recognition page when it comes to specific also offers all of our Va customers will need and work out.

After you have found your perfect domestic, possible create a deal and you can discuss brand new terminology up to both sides concur. That it agreement have a tendency to details within the a buy package.

Step 6: Domestic Assessment

Pursuing the contract are signed, an evaluation and you can Va appraisal could well be presented to guarantee the house’s well worth and you can updates meet up with the VA’s criteria. If you’re an assessment is not needed, its wise normally inspectors tend to connect of many points that a keen appraiser you are going to skip. The house inspection is commonly planned a short time just after price welcome and immediately following researching the newest report professionals employing their Hawaii Va financial typically have 2-cuatro weeks to simply accept the state of the property or even come to an agreement into the supplier credits and/or repairs become designed to the house or property. Since the check is completed and you can Virtual assistant consumers deal with this new statement, the fresh assessment is actually bought.

Step seven: Initially Disclosures, Financing handling, & Va assessment

A loan guess and you may 1st disclosures will send into Virtual assistant consumers. This type of will electronically indication and enable the mortgage top-notch so you’re able to upcoming order the newest Virtual assistant assessment. An assessment is always needed for people utilizing their Their state Virtual assistant mortgage for purchasing otherwise doing a Va Dollars-away refinance. Currently the prices try a good $900 flat fee in The state, even when this new appraiser are appraising a good 3000 sq ft family, or a beneficial 600 sq ft condominium. This might be the latest longest part of the techniques, although financing is actually published to underwriting to own conditional acceptance if you are the newest appraisal is actually queue getting finished.