Samantha Stokes, an initial time citizen, stands right in front out-of her the newest East Garfield Park household one to she shares along with her adolescent d. Stokes ‘s the earliest person to romantic towards the a home because the part of a different system the fresh Chicago Houses Power are moving out having earliest-day homeowners. | Tyler Pasciak LaRiviere/Sun-Times

Whenever Samantha Stokes’ daughter moved within their the brand new Eastern Garfield Park house the very first time, the newest teen became popular their own shoes and you can ran around the home.

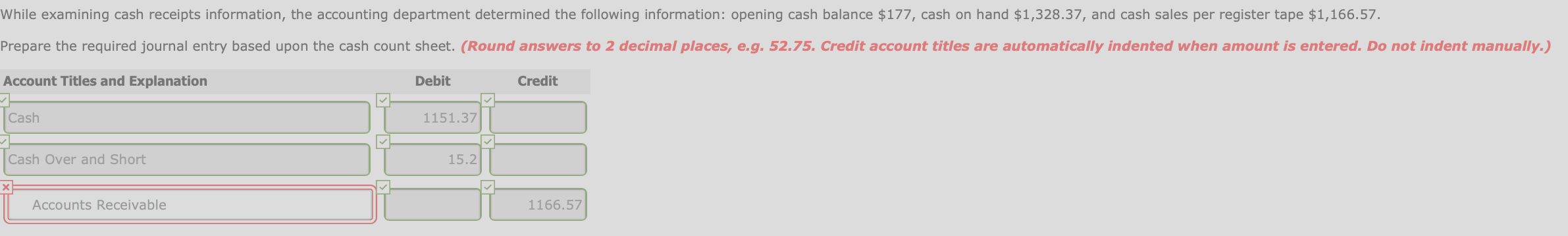

Professionals need to have at the least $step 3,000 for the offers

Very the first thing, she would go to see the huge garden that individuals keeps, plus the garage and you may things such as one once the she’s never ever had you to in advance of, Stokes remembered. It absolutely was just excitement on her face, as well as to this day will still be hard to believe I’m an authentic citizen.

From the per month before, Stokes, 38, closed on her behalf basic home to possess herself and her fourteen-year-old child. She come examining to find a house this past 12 months just after she learned their unique housing possibilities coupon from il Construction Expert perform most likely phase out because the a current jobs promotion increased her income.

Stokes was a student in the whole process of protecting a house through the agency’s Always Own program if the agency told her regarding the the new Advance payment Direction System these were establishing who would provide an offer all the way to $20,000 getting a down-payment and you can closing costs. Stokes told you it felt like a perfect violent storm – into the an effective way.

I became thus personal toward new closing time away from my domestic, it wound up working out really well for me payday loan Hanover, she said.

Samantha Stokes, a first-day resident, stands on the backyard out of her the fresh East Garfield Park family that she shares together with her adolescent daughter on the Thursday. Stokes is the earliest person to personal towards a property since part of a different sort of program the latest Chicago Homes Power is actually moving out to possess very first-day homebuyers, the brand new Downpayment Guidance System.

Stokes is the agency’s very first participant to shut to your a property within the the advance payment assistance system. The latest $20,000 is forgivable shortly after 10 years.

Discover currently more than 12 most other participants about Stokes who have been deemed entitled to new offer and generally are in the the procedure of to order a home, told you Jimmy Stewart, the new movie director away from home ownership having CHA.

The brand new agency strategies it could be capable help throughout the 100 users throughout the program’s first 12 months, Stewart said. The applying is actually funded due to government funds from new You.S. Service out-of Houses and you may Urban Creativity.

While Stokes got a homes coupon through the construction authority, Stewart said the application try open to anybody – and additionally men and women life outside of Chicago – as long as the house bought is within the city’s limitations.

But not, the program really does tend to be most other qualification conditions, such as for example getting an initial-go out homebuyer who can use the property because their no. 1 residence, the guy said. On the other hand, recipients’ income should not meet or exceed 80% of one’s urban area average earnings.

That means one adult’s money are going to be at the or less than $61,800, and you will a household out of three need to have a family of money out-of otherwise lower than $79,450.

Brand new houses power would like the application form to aid voucher owners who are nearing 80% of city median earnings, meaning he’s receiving reduced recommendations but can be skeptical off trying to homeownership, Stewart said. CHA residents just who make just above the 80% tolerance due to change on their income is to nevertheless use, particularly because they’re more than likely to your verge out-of losing a discount or construction recommendations.

The applying will come because financial prices consistently raise across the country. 57% this past day, the new Related Force reported.

Due to the climate that individuals come into when it comes to mortgages right now and other people going out to help you homeownership, Stewart told you, we think this sets all of them when you look at the an aggressive advantage and you may allows these to be able to find the household and possess provides a reasonable monthly mortgage amount which is it’s doable rather than CHA recommendations following.

Stokes obtained $20,000 regarding the the latest homes expert system, along with an alternative $10,000 regarding a different sort of guidelines system. She along with used $5,000 of her very own savings purchasing south west Front, modern-day solitary-family home, and therefore required altogether she had simply over 15% of one’s total price of the property.

She in earlier times lived in a small a couple-room apartment, nevertheless brand new home now offers extra space having by herself along with her daughter. Stokes said she actually is repaying to the their particular home filled with a big kitchen area in which she already envisions youngsters running around while in the future friends score-togethers. An out in-tool washer and you can dryer setting she not must generate travel towards the laundromat.

Their brothers and you will father provides offered to make needed repairs, though the house is another framework. Their particular mom, just who existence close, happens to be a frequent visitor.

They all need certainly to choose the excess room and you may state which is its space when they come over, she said.

The pace to have a 30-12 months home loan flower to eight

Samantha Stokes, an initial-day resident, stands about home out-of their unique the latest Eastern Garfield Playground house that she shares along with her adolescent child. Stokes is the basic person to close towards a home while the part of an alternate program the latest il Houses Authority is actually running away to own first-go out homebuyers.