You can now support the secrets to your dream family without money files in hand. Household First Monetary institution possess a special Financial System.

You will find incredible recommendations for earliest-go out homeowners. Whether or not you have got formal spend proof, you can now hold the keys to the optimum domestic. Regardless if you are an everyday choice otherwise work with the casual urban area and take on their week-to-month pay for the a real income, you could submit an application for a straightforward Financial from your home Very first Monetary institution.

Having lodging will cost you removing, a bottom way of life and you will high go out-to-go out environment are significant products in such a case. For every single people for the world possess a fundamental dependence on a great spot to name Household. Many individuals, whatever the case, are declined which you prefer due to a lack of enough time-long-term organization and you can spend.

What is Zero Income Proof?

In non-commercial nations including our very own, extreme piece of the people falls toward LIG (Low-pay pile) and you will EWS (Economically Weaker Section) categories, being as frequently as possible dismissed whether or not it comes to eating, health care, schooling, or extremely important financial. To get a number inside it, there are around 15-20 million underbanked some one, and you can a considerable significant these folks lack undeniable facts regarding commission. That’s, they usually have a income, although not, they can not see they written down. This is on account of selection of reasons, for example, the way in which they are utilised but are paid-in actual money, or that they run advance cash in Simsbury Center Connecticut independent companies that commonly sure-enough signed up. A server administrator during the a launch range, for example, or an autorickshaw driver are two cases of including pages. Absolutely nothing manufacturers and advertisers, such as, the new Kirana shop on your own mohalla or the Pani puri wala your competition to each nights, will most likely not method whatever assistance, let alone simple domestic loans. As they you desire recompense, they are aware little concerning the conceivable outcomes accessible to all of them into the new scout.

Absence of Money Research

When you look at the India, a big little bit of the population drops towards the LIG (Low-spend event) and you will EWS (Economically Weaker Section) kinds, that are as much that you can overlooked of the our very own country’s practical monetary base. Up to fifteen-20 mil individuals are financially averted because they do not possess affirmed verification regarding commission. This infers they’ve a wages not developed short to the methods to see they written down.

Cash Settlement: One is used yet , allows the settlement when you look at the real cash. As an example, remember an individual who serves as an associate during the an excellent Kirana store.

By themselves operating: Someone who retains an exclusive organization and you will produces a specific measure of cash, the spend isn’t predictable. For-instance, check out the driver off an auto-cart.

Occasional Earnings: They are used for many days into the confirmed seasons and you will procure an appartment complete which can history them the others of the year. Resellers regarding fireworks, for instance.

Individuals Quicker Revenues: They work in selection of casual ranks. Such as, imagine an excellent homegrown staff who performs from inside the a variety of families.

Dependence on Mortgage for everyone

To purchase a home demands enormous speculations since the family turns into the biggest investment one to a person can keeps. Such enormous speculations normally fatigue a great number of people’s investment money, next, we divert so you’re able to acquiring bucks from financial institutions as the Home loans in order to satisfy its attract of getting a property. That important disservice of your entire period is the fact not totally all portions off society approach particularly bank advances.

Even though they is fit for reimbursing a progress, borrowers know-nothing regarding the market’s applicants. They feel that due to an absence of files, they will be incapable of rating a house borrowing from the bank using a customary bank, that they undertake is the chief solution to get funding to have the purchase of property. He is not aware that Reasonable Homes Creditors, such, Household Earliest Finance company may help them and encourage these to discover the desires.

New dream is the fact that the bank’s average routine involves gathering individuals suggestions on the debtor to guarantee they are complement reimbursing the bucks he’s delivering.

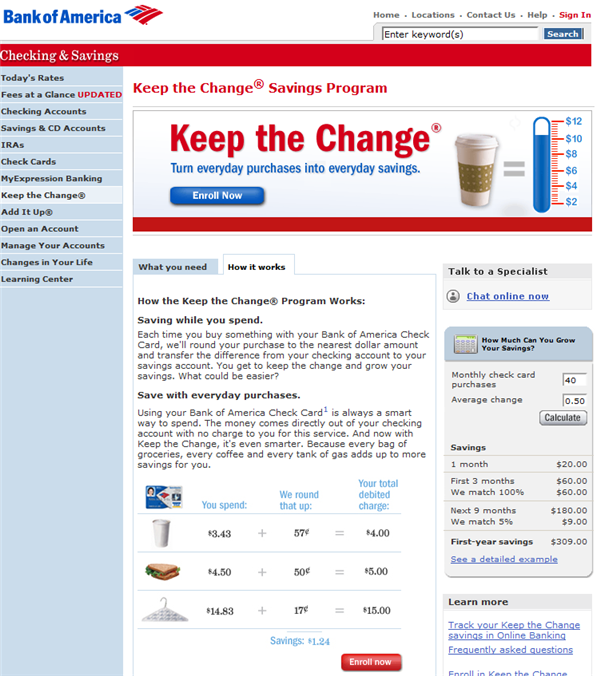

Introducing this new dream, groups instance NBFCs (Non-Financial Financial institutions) are formulated offered to specific servings out-of area. Eg connectivity make advances in place of requiring one proof fee.

In general, exactly how correctly performs this tool functions?

This really is possible at HomeFirst. We do not overpower the newest customer having a tremendous run-down out of profile or a huge number out of schedules, most of which they could perhaps not understand. Instead, i see that have website subscribers and you can hear their account, additionally the demands he has got educated, to decide their certification having a home loan.

We don’t believe paperwork is the better solution to take a look at the customer’s trustworthiness. We do not totally accept that a settlement stub have a tendency to stop if the the client will in reality have to reimburse the financing. A payment slip is basically an item of report that shows just how much our customer are paid down. In any case, all of our monetary arrangement was setup as a result it support the organization into the deciding the customer’s goal and restitution capabilities.