Restrict mortgage limits will vary of the county

- Sms

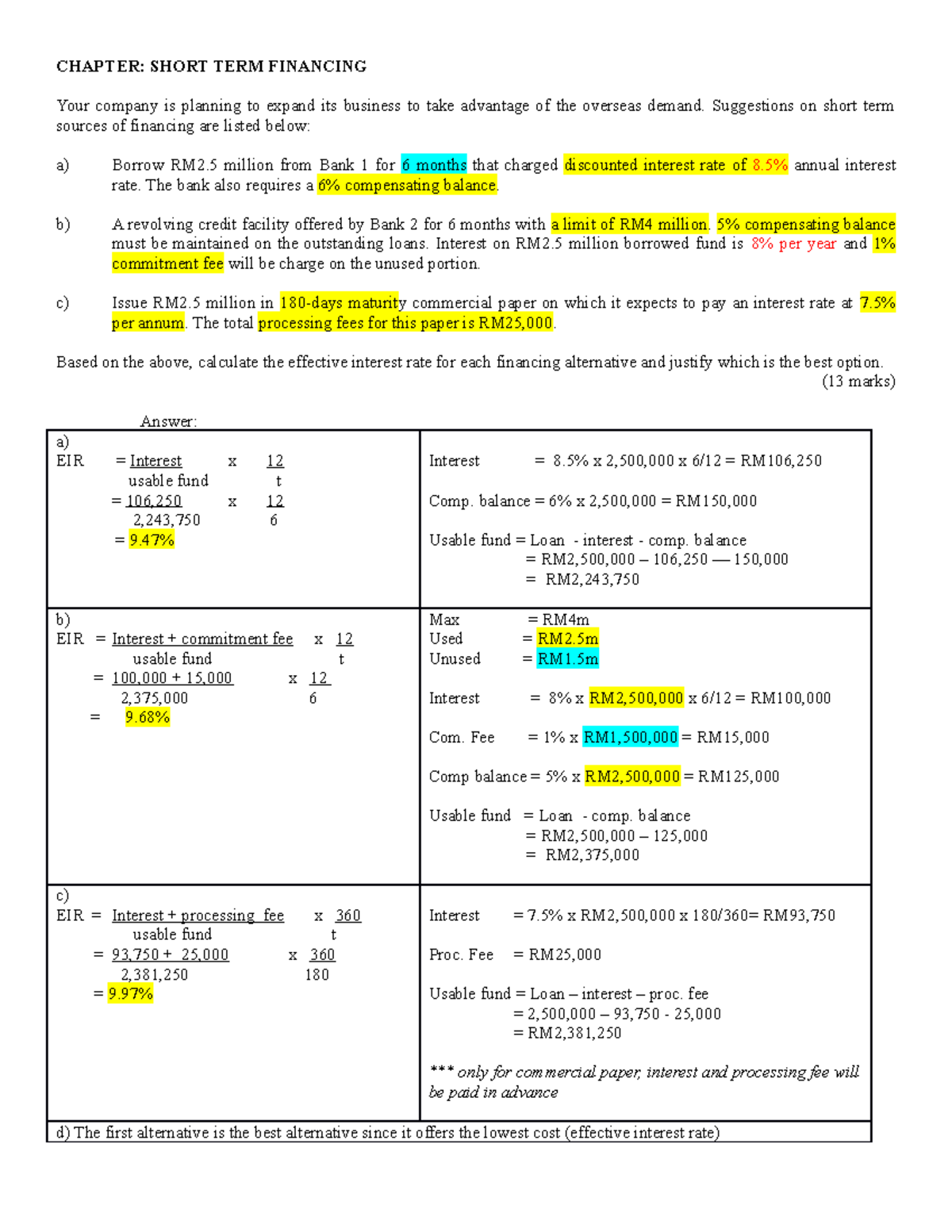

A map of your own United states proving Section 184 mortgage approvals during the per state since , the most up-to-date map brand new Construction and you will Metropolitan Invention keeps. Housing And you will Urban Invention

Maximum loan restrictions are very different because of the state

- Text messages

- Print Copy article link

Restrict mortgage constraints vary by the state

- Text messages

- Printing Content article link

TAHLEQUAH, Okla. — Of several Indigenous Americans can get qualify for mortgage brokers through a You.S. Property and you will Metropolitan Advancement system which is resided for more than a few decades. The brand new Point 184 Indian Home loan Make sure System features versatile underwriting, actually borrowing-rating created in fact it is Local-particular.

Congress built they during the 1992 to helps homeownership from inside the Indian Country, and many of their positives are low down repayments without individual mortgage insurance policies.

“I just believe it is a system, and i purchased my own personal house this,” Angi Hayes, a loan founder getting initially Tribal Financing when you look at the Tahlequah, told you. “I just consider it’s so wonderful, (a) program more anyone should become aware of and you can without a doubt brand new tribes should become aware of.”

“In which I works, the audience is the absolute most educated nationwide, which means that i create alot more (184 money) than simply probably any other financial,” Hayes said. “There are numerous causes that it is probably a lot better than FHA (Government Houses Management), USDA (U.S. Institution from Agriculture) or antique financing. Frequently its lesser at the start. Such as, FHA is just about to cost you step 3.5 per cent off. I costs 2.25 %.”

Hayes told you inside Oklahoma the most financing she will already offer is actually $271,050. “The fresh new debtor try adding one to other 2.25 %, therefore the $271,050 is not necessarily the largest purchase price you could have, it is simply the biggest loan amount I’m able to manage.”

“Which is even the biggest myth into 184 mortgage, that always are involved with your own group otherwise with status since the Native American, they usually are a reduced or average-earnings disease,” she said. “The wonderful thing about new 184 is that it is not low-income and is also not just getting very first-date homebuyers.”

Hayes told you if you are HUD has no payday loan Guilford Center need for a specific credit score to help you qualify, she requires a credit file to decide an applicant’s loans-to-income proportion. She as well as needs shell out stubs, tax and you will financial statements and also at minimum a few different credit which have 1 year value of following.

“I could tell individuals I am not a cards counselor, however, because of the way we would the approvals, whenever i pull borrowing I’m looking at the meat of statement,” she said. “Essentially, you devote your income and the financial obligation in your credit file therefore include it with the fresh suggested domestic commission. These two some thing to each other can not be over 41 percent out of your full revenues. That is the way i regulate how much you might be accepted getting.”

“I’m trying to find no late payments over the past 12 months,” she told you. “Judgments, you need to be 2 years out of the go out it is actually recorded and you will reduced. We are in need of zero stuff with balances if you do not provides proof that you have reduced no less than one year involved. If you would like think of it a wise practice, what i give men would be the fact we don’t should hold your own bad record against your.”

The fresh new 184 mortgage has also a minimal down payment requirement of 2.25 percent to possess financing more $50,000 and step 1.25 % having funds below $fifty,000 and fees .25 percent a year getting individual financial insurance policies. Since the loan worth is at 78 per cent, the insurance would be decrease. The buyer and pays just one, step 1.5 per cent loan fee, and that’s paid-in bucks it is constantly additional to the the borrowed funds count.

“If i has anybody walk in, I earliest need certainly to find out what their requirements is,” she told you. “In case your borrowers want to apply on their own, I’m going to provide them with the various tools that they have to know while they are happy to pick. If they simply want to create an even get, We highly advise people to rating pre-accepted before it begin looking during the assets, simply because is looking at something that is means more or method less than its funds.”

The loan can also be used to refinance a preexisting household home loan, Shay Smith, movie director of the tribe’s Home business Guidelines Center, told you.

A special attraction would be the fact it may be mutual towards tribe’s Financial Guidelines System for family purchases. New Chart helps residents plan homeownership which have customized borrowing from the bank training and you may class room education and provides advance payment guidance ranging from $10,000 in order to $20,000 having first-time homebuyers. not, Map applicants have to see income advice, end up being earliest-time homeowners, complete the called for documents and you will applications and you may complete the homebuyer’s knowledge groups.

Work regarding Loan Ensure within HUD’s Place of work away from Native American Apps claims the fresh new Part 184 mortgage loan loans made to Indigenous borrowers. The loan be sure assurances the lending company that the funding will be repaid entirely in case there are foreclosures.

The newest borrower applies to your Point 184 loan which have a playing lender, and you will works closely with the fresh tribe and you will Bureau away from Indian Points when the rental tribal residential property. The lending company then assesses the necessary mortgage documents and submits the fresh loan to possess acceptance so you’re able to HUD’s Place of work of Financing Make certain.

The loan is restricted to solitary-family members construction (1-4 gadgets), and you may fixed-speed financing to own thirty years regarding quicker. Neither adjustable speed mortgage loans (ARMs) neither industrial property meet the requirements for Point 184 loans.

Finance need to be manufactured in a qualified urban area. The applying has exploded to add qualified portion beyond tribal believe homes.