Lower Financial Insurance coverage The latest monthly home loan insurance into USDA financing, called the be certain that fee is gloomier than it is some other government-backed mortgages, such FHA financing.

Fixed Rates The USDA home loans are provided towards the a predetermined mortgage rates. This means that the rate remains an equivalent and you will really does maybe not to improve otherwise change such as for example they do which have a changeable rate mortgage (ARM), that may end up in sudden surges in rates and money.

Wanna see if you be eligible for a USDA mortgage? We can help fits you with a home loan company which provides USDA financing within the Alabama. Click here to view our very own Recommended Loan providers.

USDA Loan Frequently asked questions

Here are a few of the most frequently asked questions regarding USDA loans. You can also see more inquiries and you can answers regarding the USDA fund, at the RD.USDA.GOV.

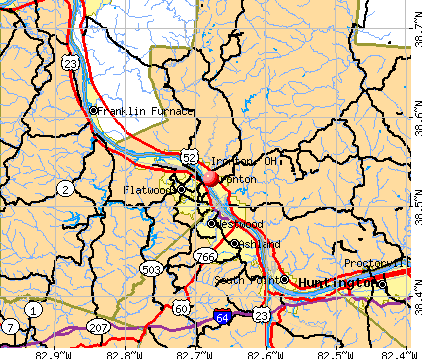

Do the home I am looking for get be eligible for a good USDA Loan? – View here on USDA Property Qualifications Chart

Carry out USDA loans require that you getting a first time household client? No, you don’t need getting a first and initial time home customer. You will be an earlier citizen whilst still being qualify for an excellent USDA loan. For those who already own property, you must sell regardless if, because the USDA fund are merely to possess a first house, and not a moment family, investment property, or travel family.

Would I create so you’re able to much to help you be eligible for an excellent USDA Loan? Follow this link to see Alabama Money Need for USDA Money

What’s the restrict number that we can borrow? There aren’t any direct financing restrictions getting USDA loans, and there’s some other mortgage products particularly FHA and you can compliant (conventional). Extent that you personally is also acquire would-be determined primarily dependent your debt-to-earnings ratio. This is certainly computed considering your own monthly money and you can month-to-month expense. New maximum DTI ratio (unless you has actually compensating things eg coupons otherwise great borrowing), is 43%. When you create $5,000 during the combined earnings, the complete expenses (homeloan payment or any other expenses including automotive loans and you will borrowing cards), must not surpass $dos,150/month (that is 43% of your own $5,000 analogy we’re having fun with right here).

What refinancing solutions exists to own USDA money? After you have a good USDA loan from the modern acquisition of your home, your range refinance to the upcoming loans. This is actually the same in principle as the FHA or Va improve apps, which can be an amazing refinance unit. The fresh new USDA improve re-finance will bring an easy way to quickly remove your homeloan payment. It doesn’t need a new appraisal (the only out of your unique pick can be used). There is no need to submit any records for your occupations otherwise income, without credit score assessment will become necessary. It is a simple and effective way americash loans Red Bay to lessen the notice rate and mortgage payment.

Easily try denied getting good USDA head loan, must i sign up for new USDA secured mortgage? Yes, your positively normally. Lots of people or spouses who apply for new head loan is turned down on account of maybe not conference different requirements, such as those linked to money, can still qualify for the brand new USDA guaranteed financing. This new direct financing is for a low money borrowers, whereas the fresh new guaranteed financing lets a tad bit more as compared to average money to be eligible.

USDA Finance from inside the Alabama

Can i have fun with a great USDA financing to shop for an excellent duplex? The only method youre allowed to pick good duplex was if you buy one of these two products. You aren’t permitted to buy each other units regarding an effective duplex (otherwise step three devices for the a triplex, otherwise 4 gadgets in the a good fourplex). You could potentially merely acquire one tool of multi-product assets, or just one friends household (detached house, or even in plain conditions, the regular solitary product household).

Are USDA financing offered to buy a ranch otherwise agricultural property? Regardless of being supported by the usa Agency out-of Farming, USDA loans aren’t readily available for agricultural features otherwise facilities from any kind. It’s quite common to assume they will become, however the USDA rural housing finance are only to own characteristics.