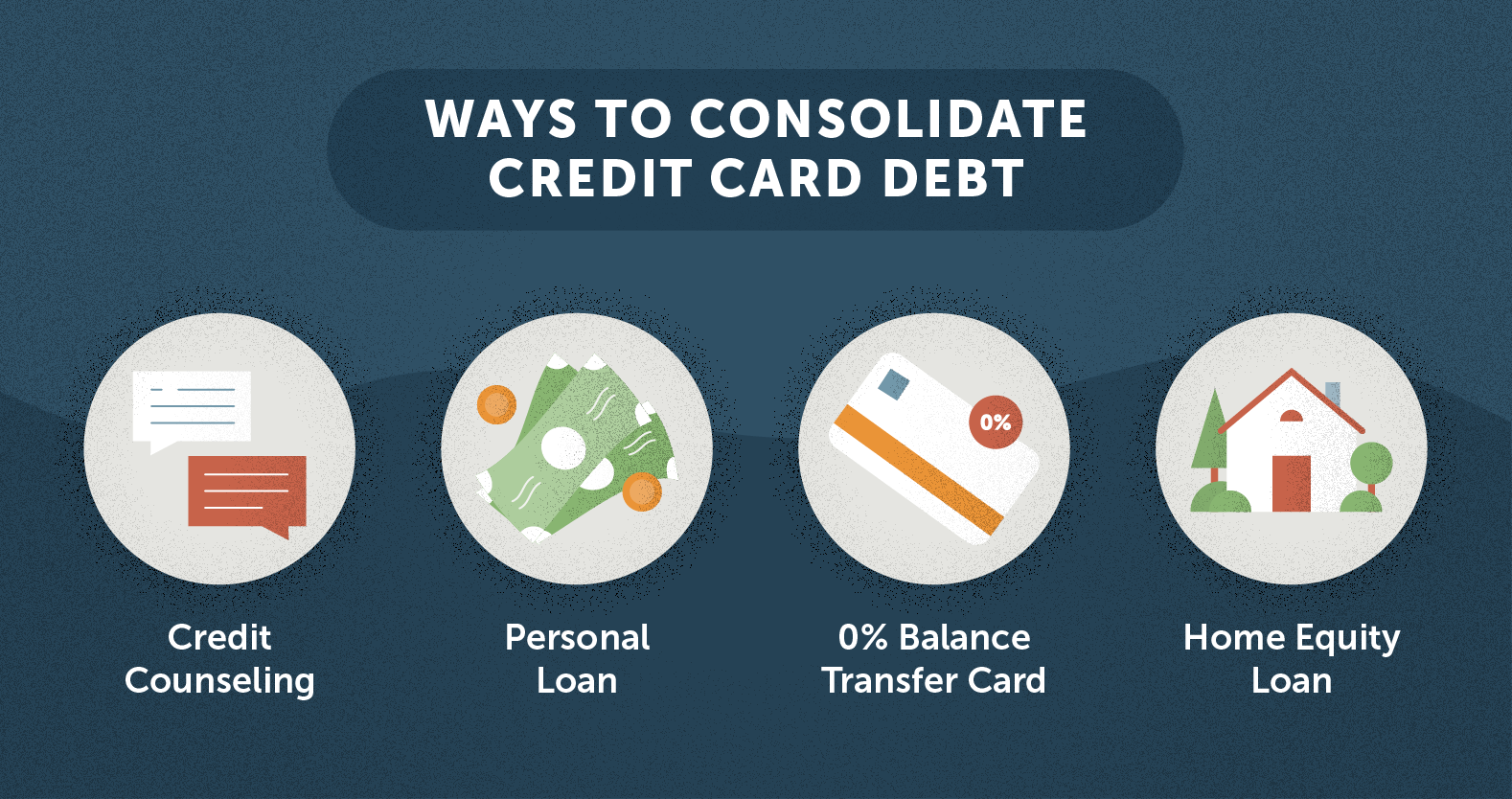

Veterans have the choice to help you discover the value of their houses due to property guarantee loan. Such loan allows pros so you’re able to make use of its house’s equity to cover various costs, for example renovations, debt consolidating, otherwise studies. Discover different varieties of domestic collateral options available in order to experts, as well as Va cash-away refinances, home equity money, and house collateral lines of credit (HELOCs). Per option have novel features and considerations one veterans shall be conscious of with regards to being able to access the home’s equity.

Secret Takeaways:

- Veterans may use household equity money to gain access to funds to have important costs.

- There are different kinds of household guarantee options available to pros.

- Virtual assistant cash-away refinances, house security finance, and you can HELOCs are typical choices for experts.

- Pros is always to carefully think about the positives and negatives, qualification criteria, and you may threats of the for each option.

- Coping with respected pros can help veterans build informed choices on the using their home’s guarantee.

Expertise Virtual assistant Dollars-Aside Refinances

An effective Virtual assistant bucks-out refinance are a valuable choice for veterans trying to faucet in their residence’s collateral. Having a money-aside refinance, pros can also be re-finance their existing mortgage getting a bigger matter and you will receive the difference between cash. This extra dollars can be used to funds some costs, particularly home improvements, debt consolidating, otherwise degree.

In order to qualify for a Virtual assistant bucks-out re-finance, pros must fulfill specific criteria. Continue reading “Domestic Collateral Financing vs. Cash-Out Re-finance versus. HELOC”