Financing prequalification ‘s the first faltering step from the mortgage processes, where a loan provider brings an effective ballpark estimate from just how much domestic you can afford. Home loan prequalification is normally simple and fast. It’s not necessary to promote data toward financial, therefore only answer a number of brief inquiries.

From the teaching themselves to prequalify for home financing, particularly when you’re a first-date household visitors, you could go shopping for belongings inside your correct spending budget, to avoid dissatisfaction more than unaffordable choice.

Simple tips to prequalify to have a home loan as the an initial-date consumer

For the majority homebuyers, step one to is homeowners was financial prequalification. But how can you prequalify to possess home financing? Luckily for us that it’s a simple process which can be done online.

In lieu of financial preapproval, prequalification are shorter rigorous and you can lenders don’t usually require an intense plunge on the customer’s monetary advice. Here you will find the standard measures so you can prequalify for mortgage brokers.

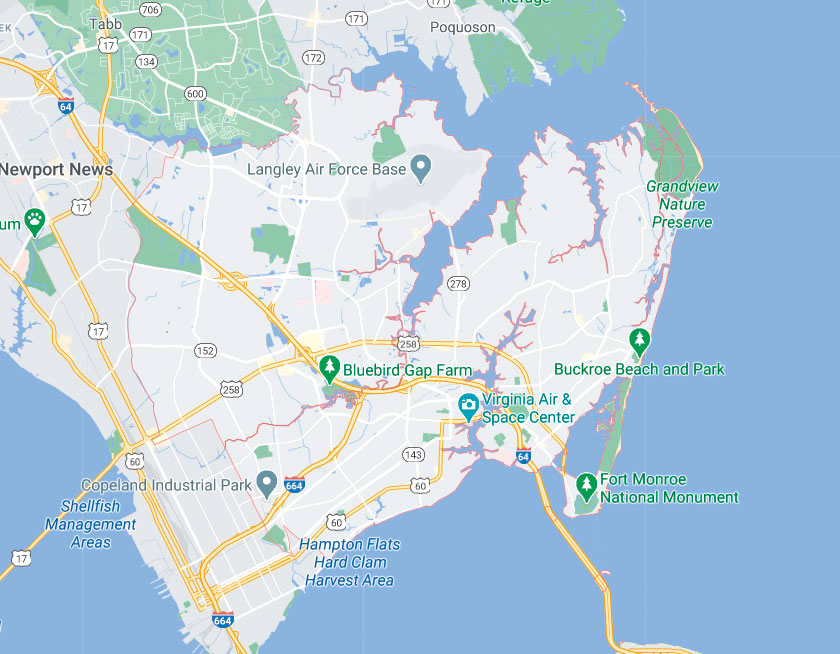

Step one is to try to discuss various lenders. For example old-fashioned banks, credit unions, and online loan providers. Per lender you are going to render some other conditions and you can interest levels, making it advantageous to compare several options to get the best fit.

dos. Offer economic recommendations

To help you prequalify for home loans, loan providers generally speaking consult basic financial suggestions and contact advice. Continue reading “Why very first-go out homebuyers must always prequalify getting home financing”