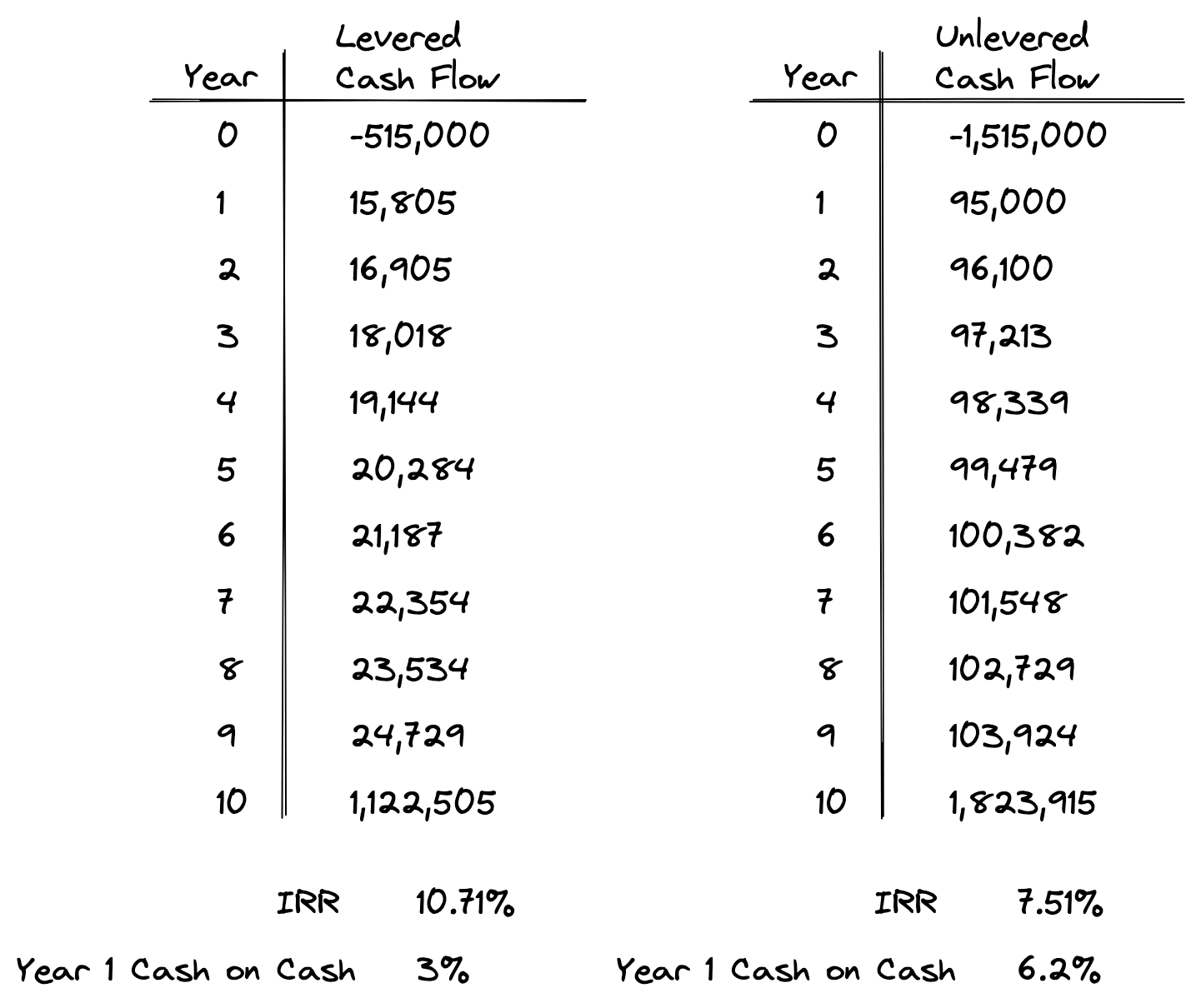

Inner price out-of return (IRR) otherwise annualized complete get back was a yearly speed obtained for each dollar invested to your several months it is invested. It is essentially used by extremely, if not completely, dealers in order to examine different financial investments. The better the IRR, the greater amount of prominent the new financial support.

IRR is considered the most, or even initial way of measuring the South Dakota installment loans new earnings out-of an excellent rental possessions; capitalization price is just too basic, and cash Move Profits on return (CFROI) will not account fully for the full time value of money.

Capitalization Price

It can be advantageous to measure the earlier cap prices regarding property to get certain insight into how the possessions has performed before, which may let the buyer so you’re able to extrapolate the possessions will get manage down the road.

When it is like state-of-the-art to measure web performing money to have a given leasing possessions, deal earnings investigation is an even more accurate alternative.

Income Return on the investment

Local rental assets investment downfalls are going to be due to unsustainable, negative dollars circulates. Earnings Return on the investment (CFROI) are an effective metric for it. Both entitled Dollars-on-Cash return, CFROI support buyers pick the brand new losings/progress on the constant cash circulates. Sustainable leasing characteristics will be are apt to have growing annual CFROI percent, always due to fixed mortgage repayments and rent income you to definitely take pleasure in through the years.

What things to Bear in mind

Generally, the better a keen investment’s IRR, CFROI, and you may limit rate, the better. Regarding real-world, it is rather unrealistic one a good investment in accommodations property goes exactly as planned or because the calculated from this Rental Assets Calculator. Continue reading “When selecting rental characteristics with fund, cash streams should be checked-out very carefully”