Training from environmental determinants focused on the fresh biophysical (10) and shopping (6) surroundings

Degree focused on a single urban area (13 degree); multiple metropolises within this a community otherwise state (8); the you’ll HOLC graded parts (7); or numerous urban centers nationwide (5). Geographic shipment are found in Fig. 3 .

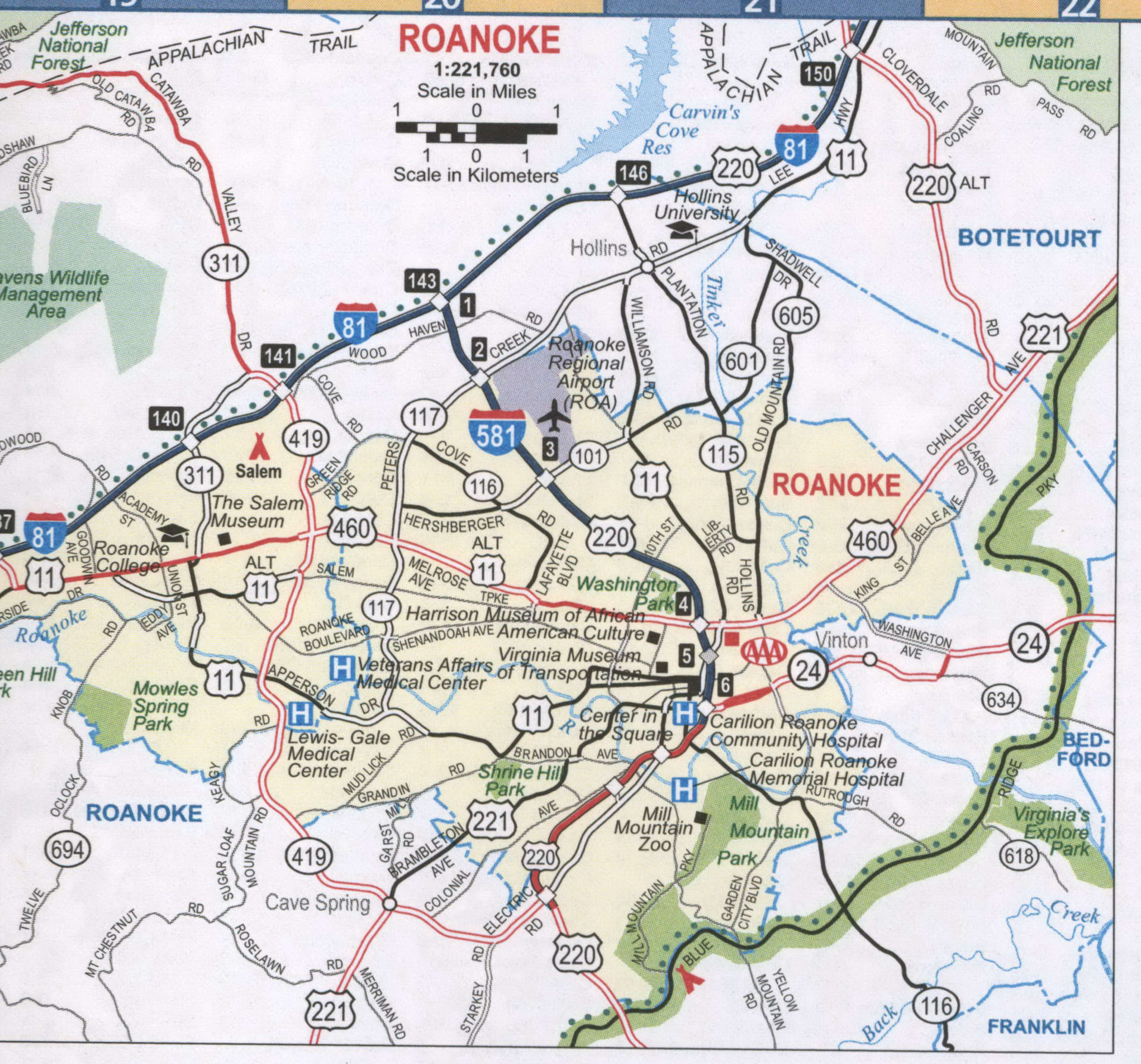

Geographic shipping of studies reporting results specific to a certain urban area otherwise county (Letter = 33), and you can showing with arrow the number of towns for every single region that have redlining maps digitized by the mapping inequality so far

Effects

Seventeen degree examined fitness-relevant consequences (Dining table ? (Tablestep 1), step one ), while 13 looked at environment determinants of health (Table ? (Tabledos); dos ); around three checked each other versions (Table ? (Tablestep three). step three ). Types of wellness-associated consequences incorporated chronic standards (5 training), maternal and you will infant fitness (5), all around health (4), injury (3), mental health (2), contagious disease (2), fitness conclusion (2), precautionary methods (2), heat-relevant infection (1), young people lead poisoning (1), and you will businesses (1). Very degree checked-out one lead, or multiple closely relevant effects; view publisher site not absolutely all education looked at numerous unrelated outcomes [ 23 , 30 , thirty two , 33 ]. Education varied about spatial accuracy of the outcome studies readily available, plus private area locations (elizabeth.grams., shopping otherwise home-based target) (10), census area (CT) (11), gridded raster urban area (7), zip code or postcode tabulation city (4), in your town discussed society (2), census take off (1), and you will city stop (1); in a single situation, it was not stated. Continue reading “Training from environmental determinants focused on the fresh biophysical (10) and shopping (6) surroundings”