Exactly what mortgage rates can i score with my credit rating?

If you find yourself a credit score off 740 usually secures the lowest pricing, borrowers having average credit may still see aggressive possibilities compliment of particular financing types.

Think of, your credit rating is just one piece of the fresh new mystery. Very let us explore your entire options to make sure that you are having the reasonable price possible for your credit rating.

- Credit scores and costs

- Home loan costs of the credit rating

- Monthly payments because of the rating

- Home loan costs because of the loan variety of

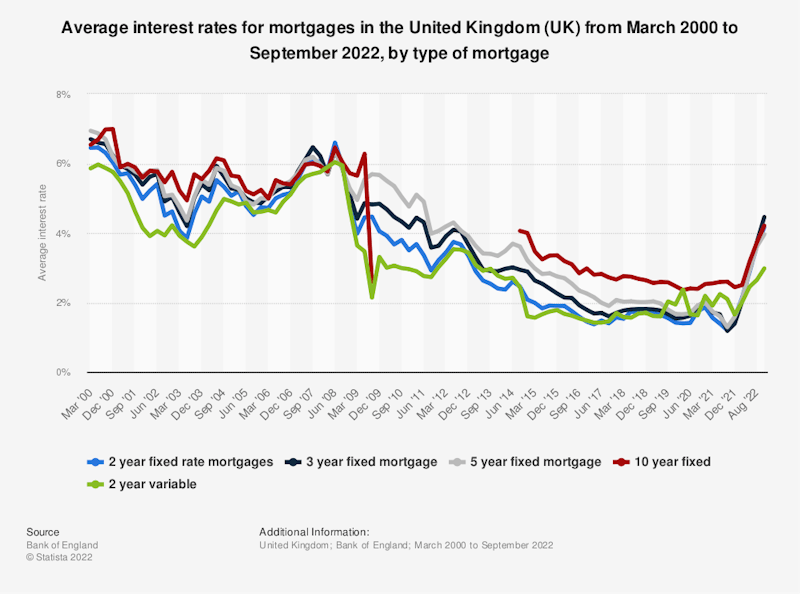

- Current financial rates

- Mortgage refinance prices

- FAQ

How fico scores apply to financial rates

Which get try a numerical way of measuring their creditworthiness, according to items such payment records, total loans, version of credit utilized, and duration of credit score. Large scores basically end in down financial costs, due to the fact loan providers understand you because the less-chance debtor.

Credit scores decided by credit agencies such Equifax and you may Experian. The complete review support loan providers evaluate the risk of lending to help you your.

Mortgage lenders will fool around with “borrowing levels” to choose rates of interest, which are based on Credit scores. FICO, short to possess Reasonable Isaac Agency, are a widely used credit scoring model. Is a review of regular credit levels and how they apply at mortgage rates:

Continue reading “Current Financial Cost by the Credit history | 2025”