What is in this article?

Memes was bits of stuff shown by way of videos, photo, text, or a personal loans Missouri mix of the three. They frequently is funny or satirical and wade viral on account of their sharable and customizable structure.

For this post, i created multiple financial memes within a few minutes playing with an internet meme generator. We are going to share these advice to supply a concept of just how to pull to one another your unique mortgage memes.

Let us talk about how you can need memes into the complete home loan marketing strategy. We’re going to as well as see almost every other procedure and gadgets to draw a whole lot more licensed prospects.

What’s a beneficial meme?

Particular users carry out all of them in the photos editing software. Anyone else merely play with an on-line meme generator detailed with photos regarding the most used memes and you may lets users to help you input their own text.

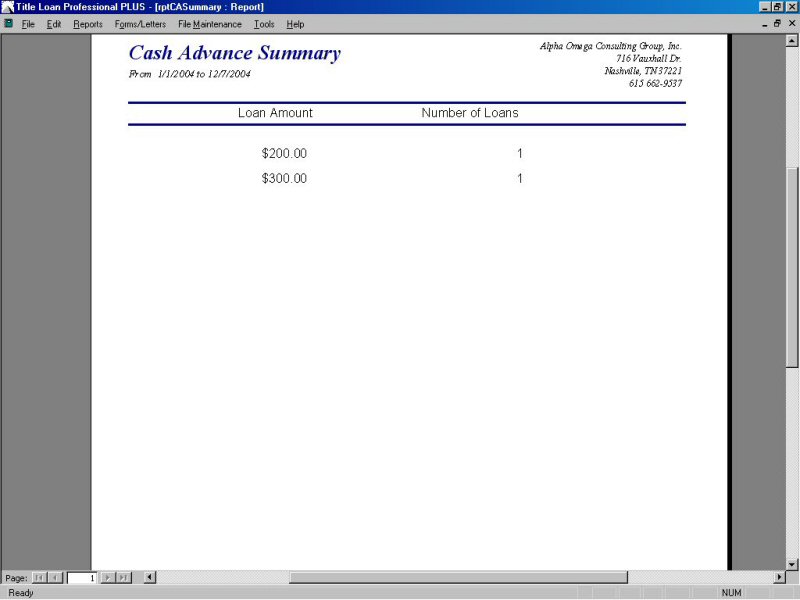

Imgflip is one of well-known meme generators. Check out the screenshot below regarding a beneficial meme we composed on the website.

You can also include your picture and build an entirely novel meme. However the extremely effective memes are from existing photo that have getting culturally relevant. Continue reading “Strategies for Mortgage Memes in your Home loan Purchases Approach”