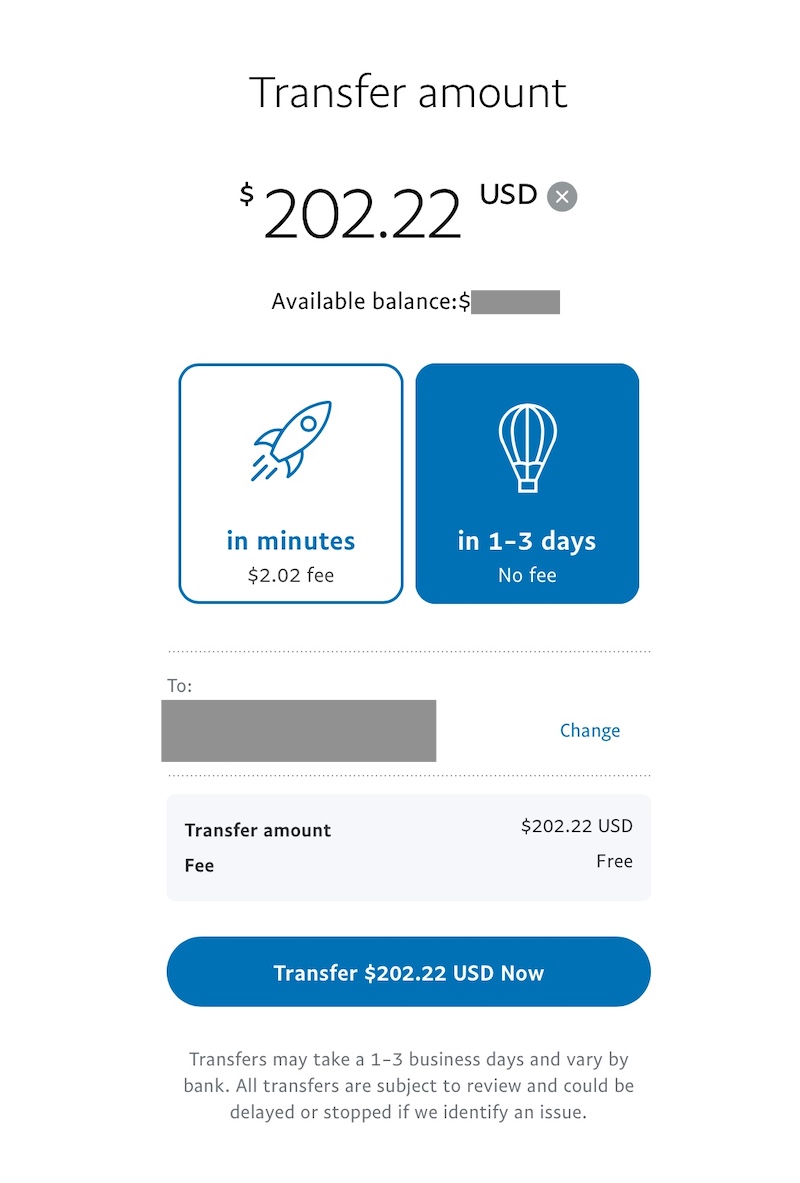

Rather, home buyers can choose so you’re able to reprice within times regarding about three, six or 12 months

As a result the requirements having increasing the costs method getting commercial individual construction mortgage interest rates, launched because of the People’s Bank from China (PBC) thirty day period before, will soon be technically used, state broadcaster CCTV reported toward Thursday. With respect to the banks’ statements and you may industry experts, this disperse will subsequent contain the deepening of great interest price marketization change, bring the fresh new steady and you may suit development of the true home markets, and raise application.

Considering this type of financial institutions, within the the fresh pricing process, they explicitly avoid a regulation proclaiming that the minimum repricing several months to have casing financing interest rates should be 12 months.

The introduction of this new rates system to have home loan appeal rates again reflects the government’s devotion to increase a property, a significant pillar out of China’s benefit, Dong Liming, a specialist during the metropolitan believe during the Peking College, advised the worldwide Times, noting your measure will assist stabilize the shape off established construction finance and you will promote markets confidence.

Yan Yuejin, a vice-president at Shanghai-based Age-family Asia R&D Institute, told the global Minutes towards the Thursday that the the fresh move support give the flexibleness off existing mortgage loans and you may rates, symbolizing a development in the rates regulations. Continue reading “Rather, home buyers can choose so you’re able to reprice within times regarding about three, six or 12 months”