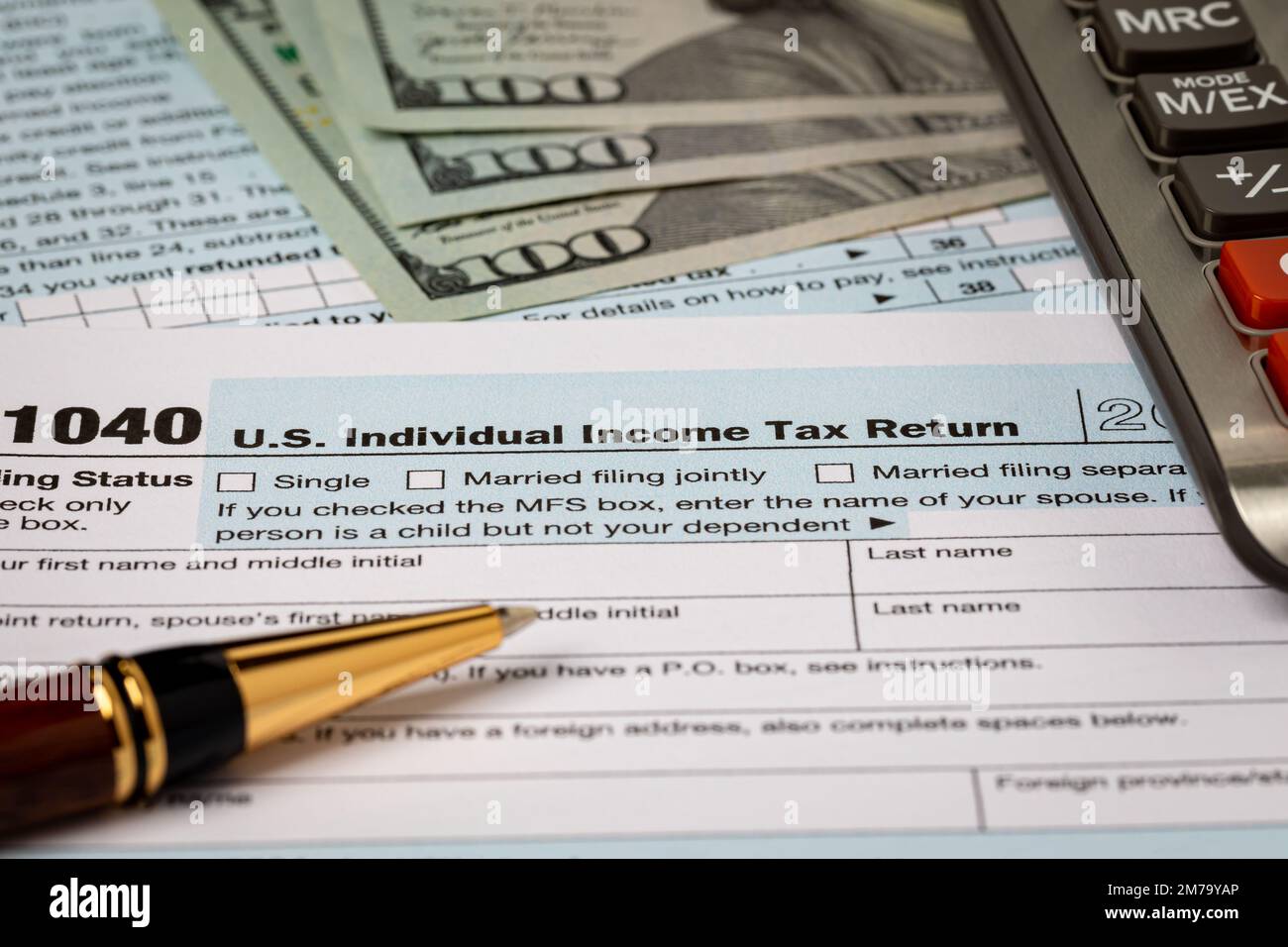

Rely on brand new number of Home loans given by HDFC Financial to acquire or build your fantasy house. You may want to choose to transfer your current Mortgage from an alternative bank out to us to make the most of the loan now offers.

In the HDFC Financial, you may enjoy glamorous Financial interest levels plus a beneficial hassle-100 % free loan application process, effortless financing fees alternatives, and versatile tenures. We offer a variety of Lenders, along with Most useful Right up Loans, Do it yourself Finance, and you can Family Expansion Finance.

Implement Mortgage On the internet

Gain benefit from the capability of trying to get a loan on line with your easy to use electronic app processes. Incase you desire some information in the process, we also provide professional advice and timely support service for all their Homes Financing issues. Continue reading “Go back home Finance for purchasing, building, remodeling, fixing, otherwise furnishing your dream liveable space”