Since your respected mortgage broker, i have access to a diverse network away from legitimate mortgage brokers for the Atlanta. This permits us to present many mortgage options designed to the financial predicament and tastes. Whether you are looking to a conventional mortgage, government-backed mortgage, or specialized program, The Financial Guy has the expertise to find the finest match to you.

Custom Financial Choice during the Atlanta GA

We realize that every consumer’s financial predicament is special. All of us at your Home loan Guy takes the time to pay attention and you may learn your position, making certain we provide you with home loan possibilities that make with your long-title expectations. Our very own purpose is to try to hold the really good terms and you can appeal rates, customized especially for your.

Streamlining the borrowed funds Processes inside Atlanta

Navigating the borrowed funds process in the Atlanta are going to be overwhelming, but with Their Mortgage Guy by your side, it becomes a delicate excursion. I manage the paperwork and you will communicate with lenders on your part, helping you save work. The masters will show you from the software procedure, taking updates and you can answering any questions you may have across the means.

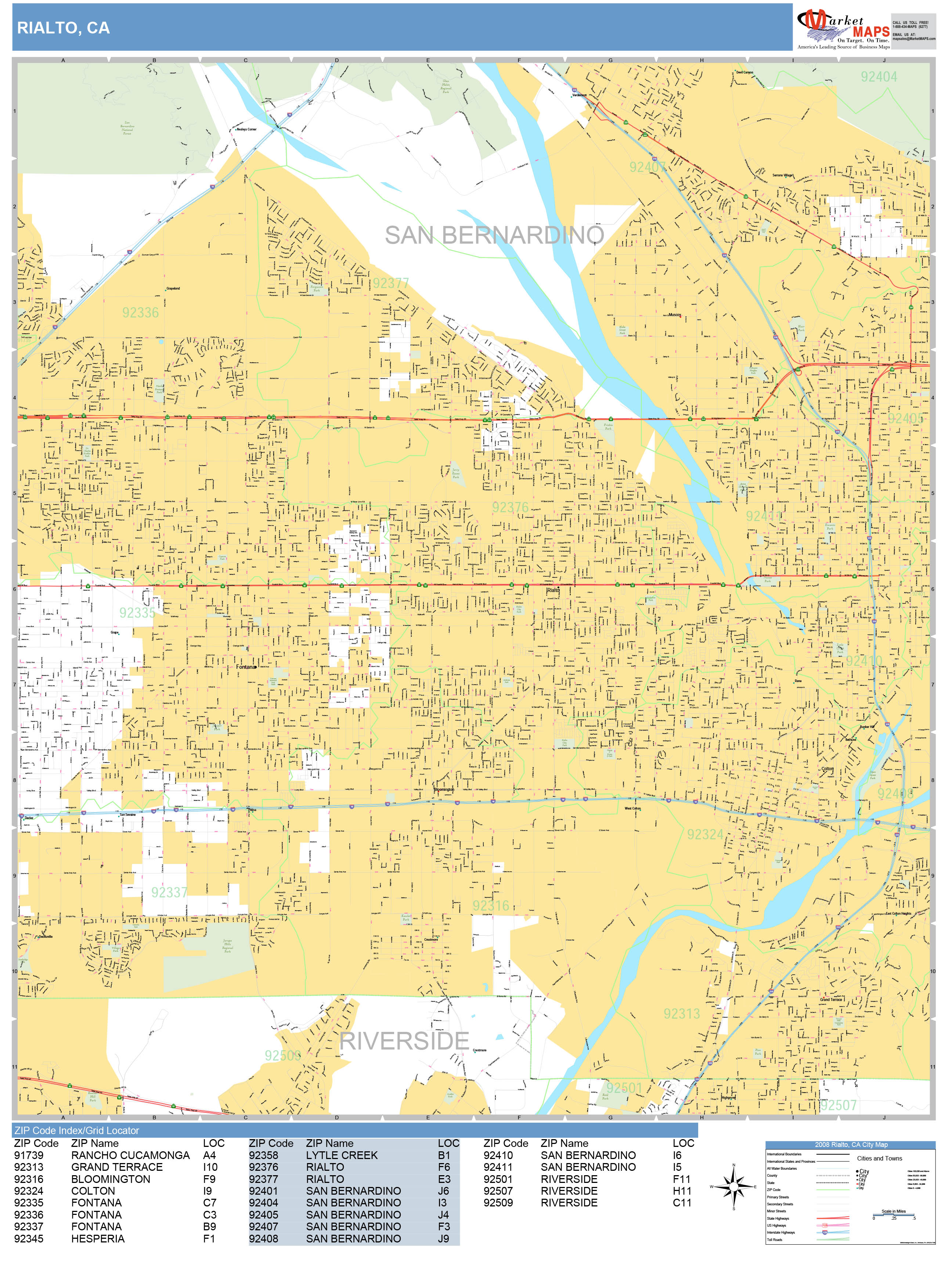

Neighborhood Atlanta Home Mentor

Atlanta was a community regarding brilliant communities, for every using its very own novel reputation and you can existence. Due to the fact a region mortgage broker, i have an intense knowledge of brand new Atlanta real estate market. Whether you are selecting the active metropolitan longevity of Midtown, this new historical attraction out of Virginia-Highland, or perhaps the nearest and dearest-amicable suburbs, Your own Mortgage Man offer worthwhile understanding in order to create told conclusion. Continue reading “Va and FHA finance even allow for large debt rates to your an incident from the instance basis”