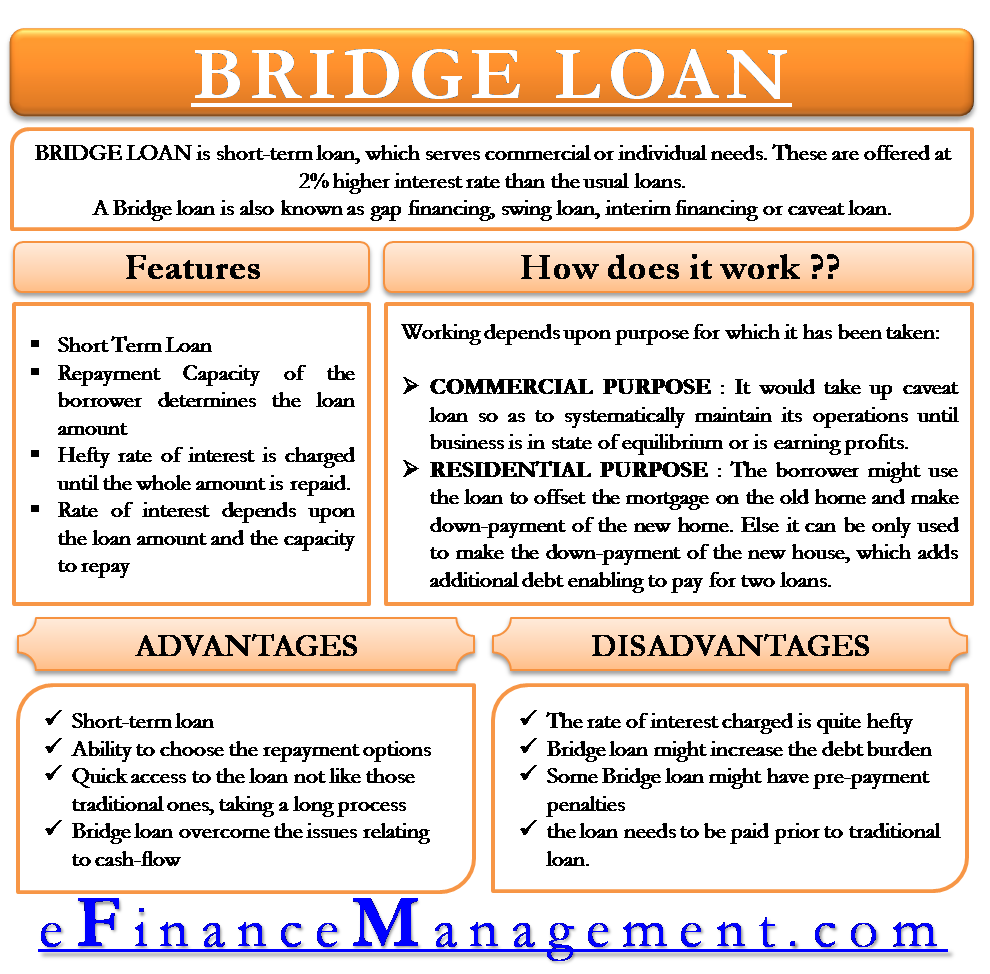

To purchase a property is a big step, and understanding the will set you back is key. As soon as we mention mortgage brokers, there are various home loan charges and you may charges that come into gamble. It is not just about credit currency; you will find a lot more can cost you eg financial charges for home loan and you may processing costs for home loan. This type of may appear complicated, but don’t care and attention! Our company is right here to split it off for your requirements. By the end from the publication, you should have a clear image of every charges and be prepared to create your fantasy domestic an actuality. Let us diving within the!

- Handling Costs

- Administration Costs

- CERSAI Commission

- Unraveling EMI-Related Charge home based Loans

- Closing Mention

1. Processing Charges

When you are all set to make your perfect house possible, its required to learn new economic parts. Of those, the house mortgage operating percentage takes heart stage. Which payment, often called a handling charge, is exactly what banking companies otherwise Non-Banking Monetary People (NBFCs) inquire about to deal with your property application for the loan. Let us break they down into easier words and you may speak about an important factors. Continue reading “Different types of Financial Charge and you may Charge inside Asia”