Lenders have made it easy for many people to understand its dream of owning a home. If you are stretched tenure loans try preferred by of several as the EMIs are in check, of several along with watch out for a means to eliminate otherwise pay back their obligations. Financial prepayment is but one such as strategy that will help you reach that goal and certainly will meet the requirements a good clear idea in the long term.

It assists you save towards desire costs

Lenders is high debts with a huge bit because the focus. After you prepay your own financing before the end of the period, it will save you dramatically.

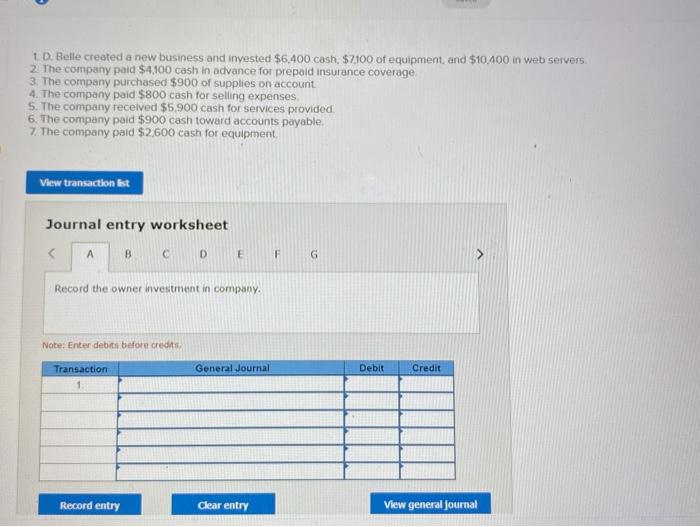

Consider this amortisation agenda for a mortgage out of ?ten lakh during the mortgage loan off 8% p.an effective. getting a tenure away from 8 decades.

Regarding a lot more than example, the complete desire amount in the financing period off 8 years was ?3.57 lakh. For individuals who prepay the loan at the beginning of the fresh new tenure, it can save you a lot into the interest prices. Along with, the interest prices spared are often used to fulfil almost every other lifetime requirements like loans for the child’s education, advancing years believed, etcetera.

Change your credit history

Settling your own finance through to the avoid of your period would mean their borrowing from the bank incorporate proportion falls. Continue reading “Just why is it best if you prepay your property Financing?”