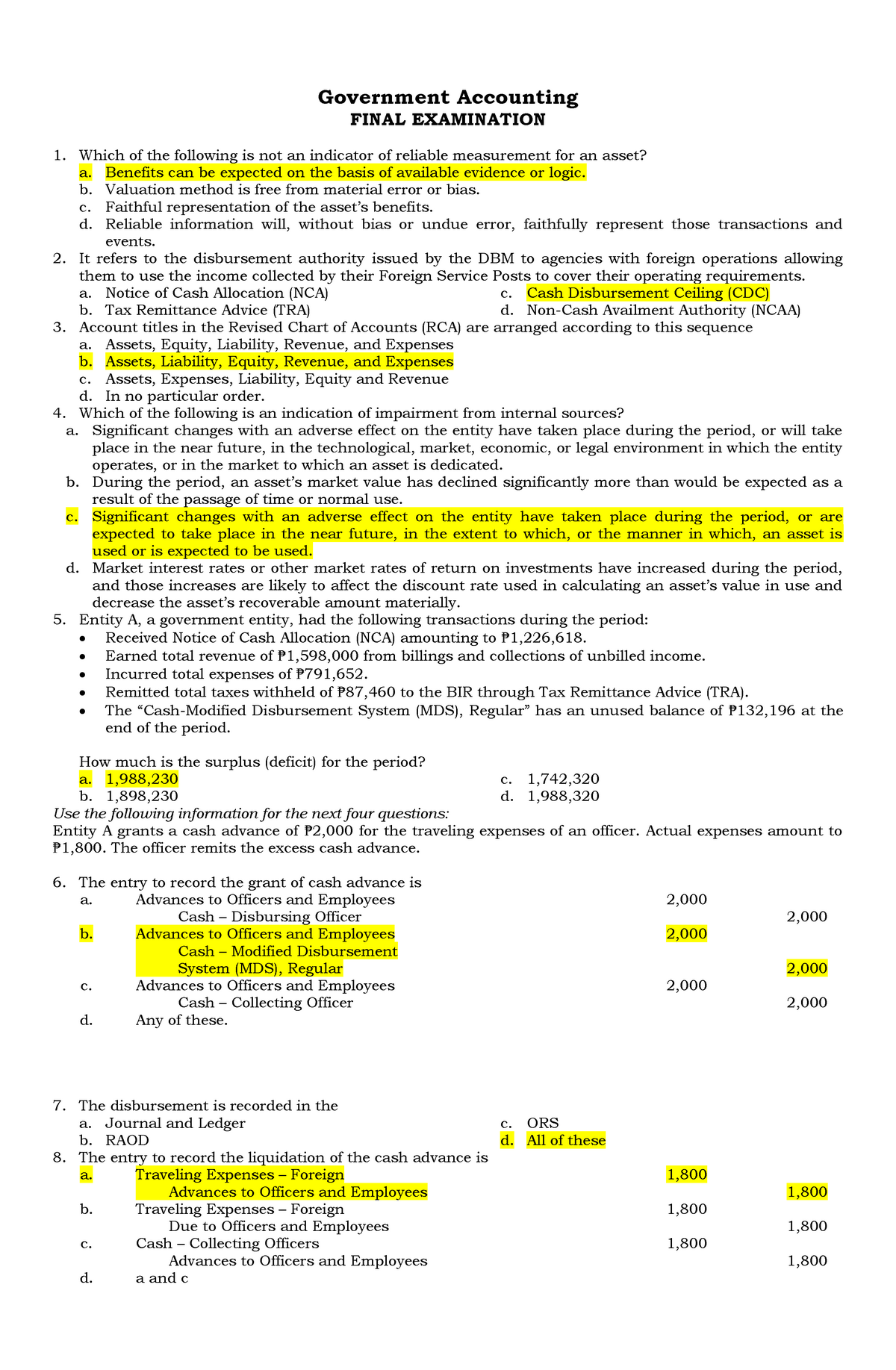

Instance a charge card, as you pay back their a fantastic harmony, the level of readily available credit try rejuvenated

Domestic Collateral Line4Me

A good HELOC is actually a credit line protected by the domestic that gives you an effective rotating line of credit, similar to a credit card. Key distinctions are you to definitely as opposed to credit of credit cards team, you may be credit regarding readily available equity of your home, together with home is made use of just like the collateral to your distinctive line of credit. Thus giving you the capacity to borrow secured on it once again in the event that you ought to, and to borrow as little or around you would like, as much as your own accepted limitation.

Home security lines of credit can be used to buy do-it-yourself plans, plus those individuals meant to improve the worth of your residence. Also, they are useful for big commands or even consolidate highest-rate of interest personal debt into most other financing (particularly handmade cards).

A property equity line of credit tend to typically have an increase that is fixed for a period of step 3 – fifteen years that have built monthly installments. This percentage stability helps it be easier for funds government.

An annual percentage rate (APR) ‘s the speed charged for borrowing fund, in fact it is expressed as the a share representing the fresh yearly price of financing along side identity from that loan.

So you can qualify for a property equity credit line, you’ll want available security of your home. Continue reading “Instance a charge card, as you pay back their a fantastic harmony, the level of readily available credit try rejuvenated”