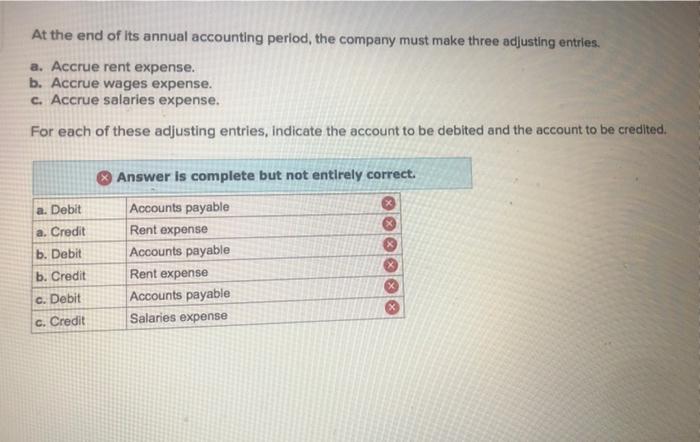

Addition

Repair finance was specialized borrowing products made to let residents when you look at the financing their home improvement methods. These finance are specifically customized to cover costs associated with remodeling, building work, otherwise updating an existing assets. Whether you’re believed a primary home restoration or to make shorter advancements, focusing on how recovery finance work is important to guarantee a soft and you can profitable investment.

How can Renovation Financing Works?

Renovation fund are financial products made to bring resource for household update methods. They make it home owners to borrow cash particularly for renovations, updates, or solutions. These fund vary from old-fashioned mortgages, as they are designed to cover the will set you back away from remodeling or enhancing a current property. If you’re considering a repair loan, it’s imperative to know the way they work plus the advantages they bring.

Locate a repair mortgage, it is possible to usually need to go as a result of a financial institution eg a financial or credit partnership. The application techniques involves bringing detailed information in regards to the restoration enterprise, such as the projected will set you back and you can timeline. The lender will determine their qualification predicated on products particularly your credit rating, income, as well as the appraised value of your home. Continue reading “How does A repair Mortgage Works? All you need to Know”